Question

Suppose a farmer requires a pre-tax rate of return of 15%, has a marginal tax rate of 25%, assigns a 2% risk premium to

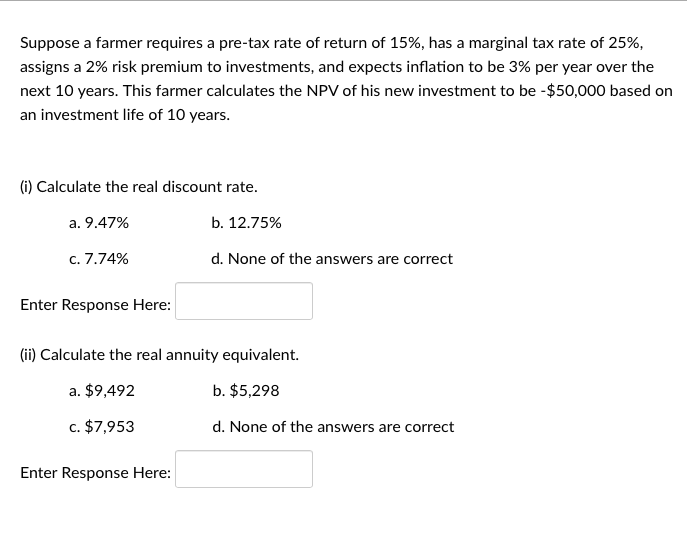

Suppose a farmer requires a pre-tax rate of return of 15%, has a marginal tax rate of 25%, assigns a 2% risk premium to investments, and expects inflation to be 3% per year over the next 10 years. This farmer calculates the NPV of his new investment to be -$50,000 based on an investment life of 10 years. (i) Calculate the real discount rate. a. 9.47% c. 7.74% Enter Response Here: b. 12.75% Enter Response Here: d. None of the answers are correct (ii) Calculate the real annuity equivalent. a. $9,492 b. $5,298 c. $7,953 d. None of the answers are correct

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Answer c 774 Real discount rate Pretax rate of return M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Markets And Institutions

Authors: Frederic S. Mishkin, Stanley G. Eakins

7th Edition

013213683X, 978-0132136839

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App