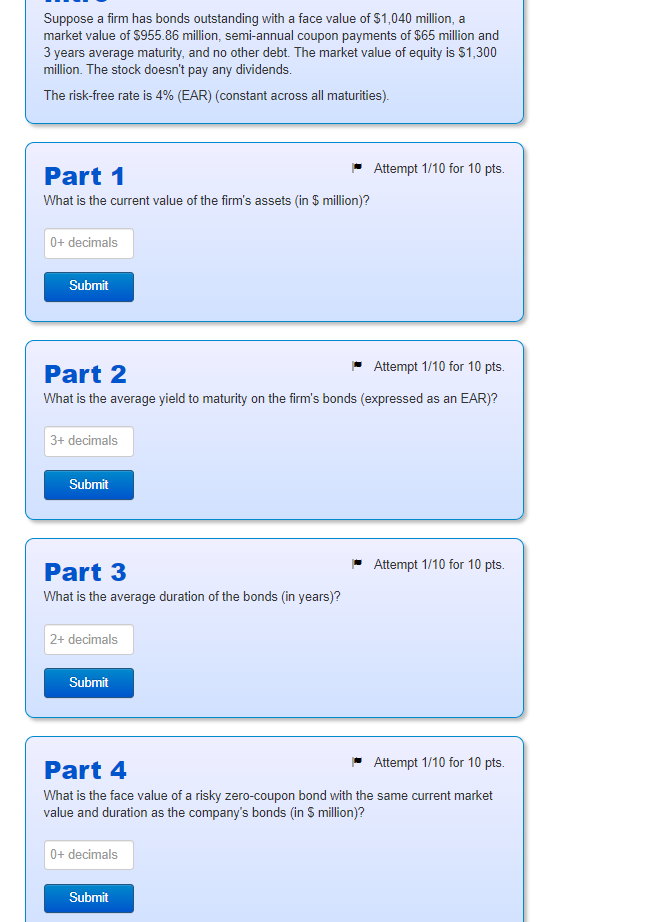

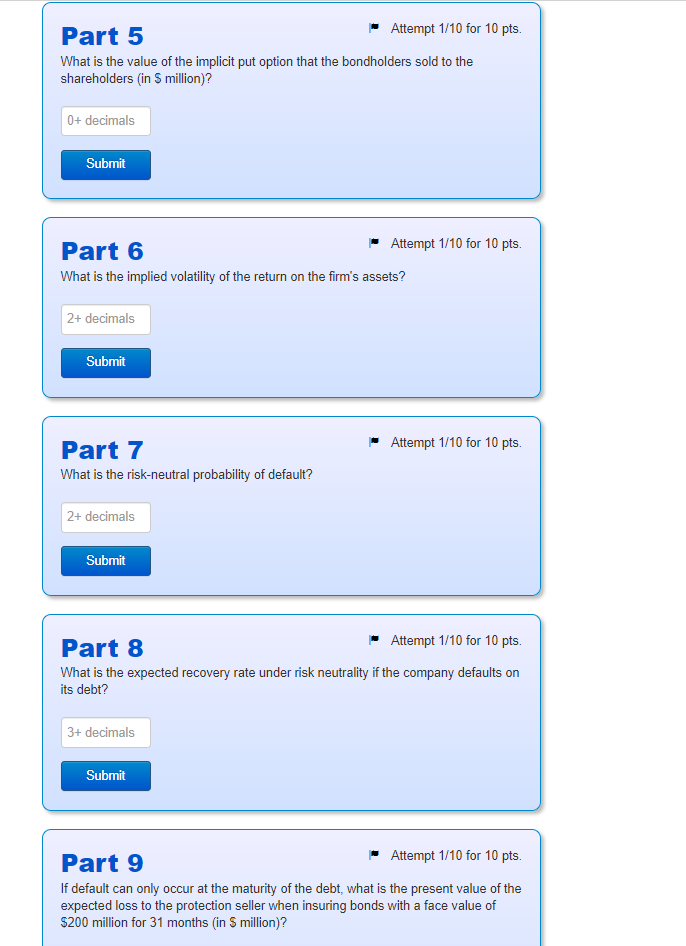

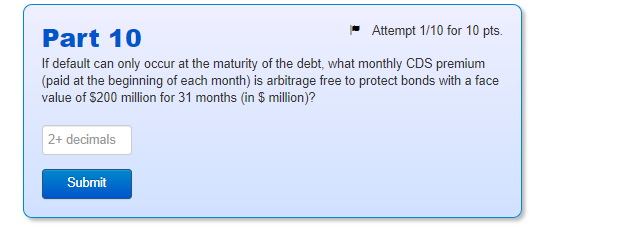

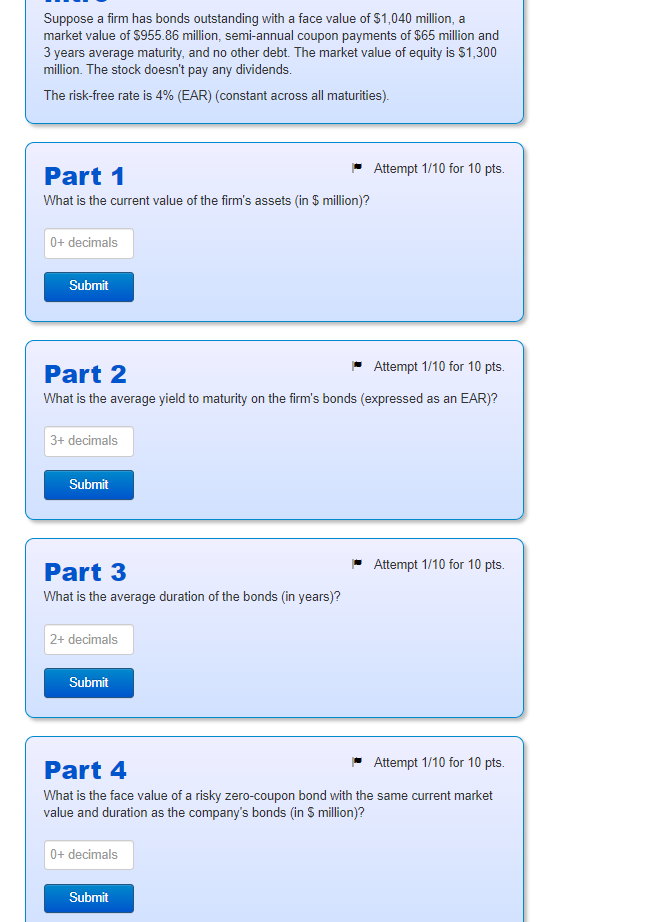

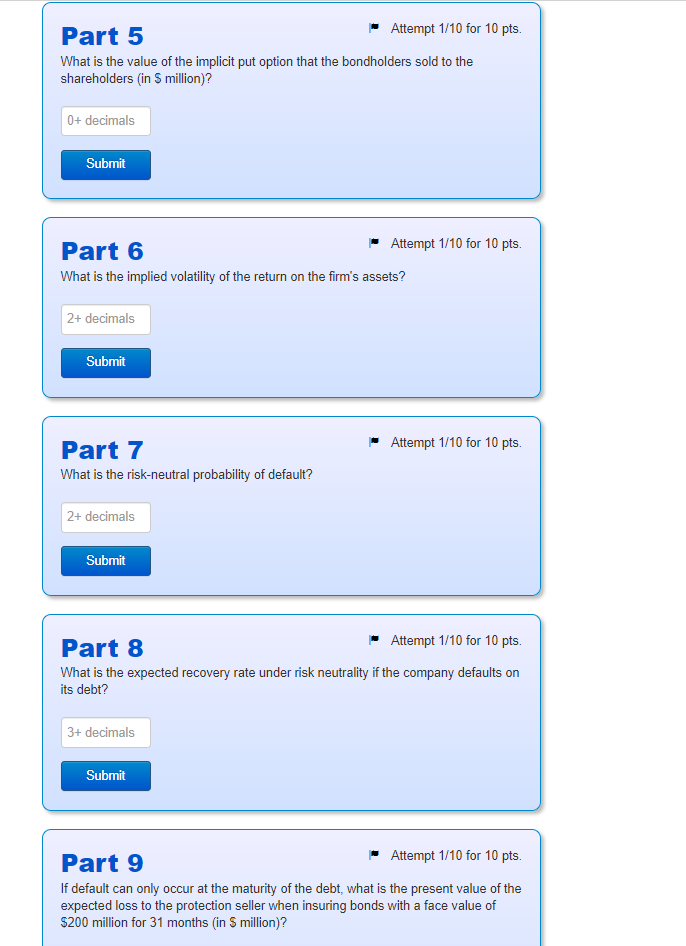

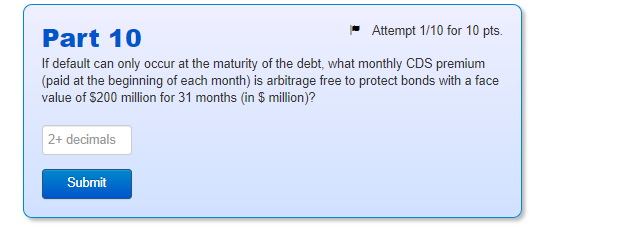

Suppose a firm has bonds outstanding with a face value of $1,040 million, a market value of $955.86 million, semi-annual coupon payments of $65 million and 3 years average maturity, and no other debt. The market value of equity is $1,300 million. The stock doesn't pay any dividends. The risk-free rate is 4% (EAR) (constant across all maturities). Part 1 Attempt 1/10 for 10 pts. What is the current value of the firm's assets (in $ million)? 0+ decimals Submit Part 2 Attempt 1/10 for 10 pts. What is the average yield to maturity on the firm's bonds (expressed as an EAR)? 3+ decimals Submit Attempt 1/10 for 10 pts. Part 3 What is the average duration of the bonds (in years)? 2+ decimals Submit Attempt 1/10 for 10 pts. Part 4 What is the face value of a risky zero-coupon bond with the same current market value and duration as the company's bonds (in S million)? 0+ decimals Submit Part 5 Attempt 1/10 for 10 pts. What is the value of the implicit put option that the bondholders sold to the shareholders in 5 million)? 0+ decimals Submit Part 6 Attempt 1/10 for 10 pts. What is the implied volatility of the return on the firm's assets? 2+ decimals Submit Attempt 1/10 for 10 pts. Part 7 What is the risk-neutral probability of default? 2+ decimals Submit Part 8 Attempt 1/10 for 10 pts. What is the expected recovery rate under risk neutrality if the company defaults on its debt? 3+ decimals Submit Part 9 Attempt 1/10 for 10 pts. If default can only occur at the maturity of the debt, what is the present value of the expected loss to the protection seller when insuring bonds with a face value of $200 million for 31 months in S million)? Part 10 Attempt 1/10 for 10 pts. If default can only occur at the maturity of the debt, what monthly CDS premium (paid at the beginning of each month) is arbitrage free to protect bonds with a face value of $200 million for 31 months in $ million)? 2+ decimals Submit Suppose a firm has bonds outstanding with a face value of $1,040 million, a market value of $955.86 million, semi-annual coupon payments of $65 million and 3 years average maturity, and no other debt. The market value of equity is $1,300 million. The stock doesn't pay any dividends. The risk-free rate is 4% (EAR) (constant across all maturities). Part 1 Attempt 1/10 for 10 pts. What is the current value of the firm's assets (in $ million)? 0+ decimals Submit Part 2 Attempt 1/10 for 10 pts. What is the average yield to maturity on the firm's bonds (expressed as an EAR)? 3+ decimals Submit Attempt 1/10 for 10 pts. Part 3 What is the average duration of the bonds (in years)? 2+ decimals Submit Attempt 1/10 for 10 pts. Part 4 What is the face value of a risky zero-coupon bond with the same current market value and duration as the company's bonds (in S million)? 0+ decimals Submit Part 5 Attempt 1/10 for 10 pts. What is the value of the implicit put option that the bondholders sold to the shareholders in 5 million)? 0+ decimals Submit Part 6 Attempt 1/10 for 10 pts. What is the implied volatility of the return on the firm's assets? 2+ decimals Submit Attempt 1/10 for 10 pts. Part 7 What is the risk-neutral probability of default? 2+ decimals Submit Part 8 Attempt 1/10 for 10 pts. What is the expected recovery rate under risk neutrality if the company defaults on its debt? 3+ decimals Submit Part 9 Attempt 1/10 for 10 pts. If default can only occur at the maturity of the debt, what is the present value of the expected loss to the protection seller when insuring bonds with a face value of $200 million for 31 months in S million)? Part 10 Attempt 1/10 for 10 pts. If default can only occur at the maturity of the debt, what monthly CDS premium (paid at the beginning of each month) is arbitrage free to protect bonds with a face value of $200 million for 31 months in $ million)? 2+ decimals Submit