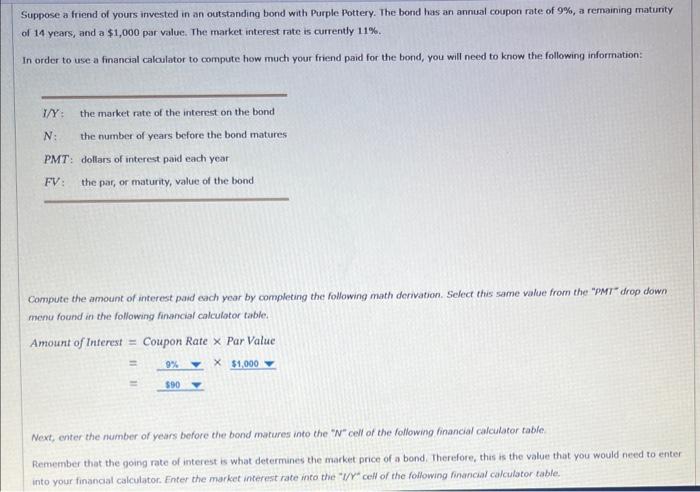

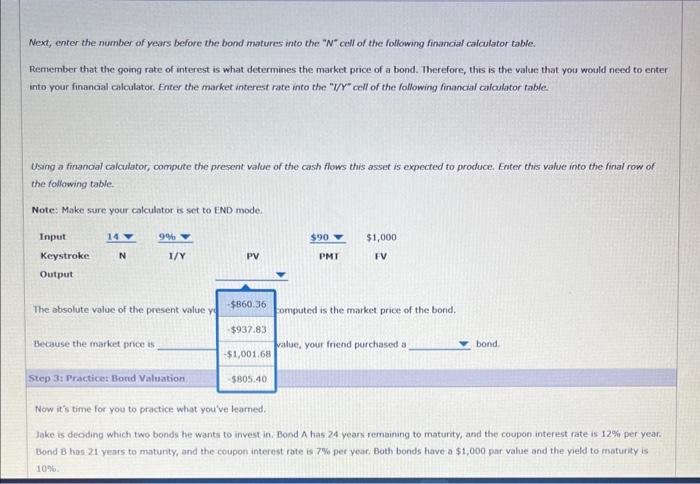

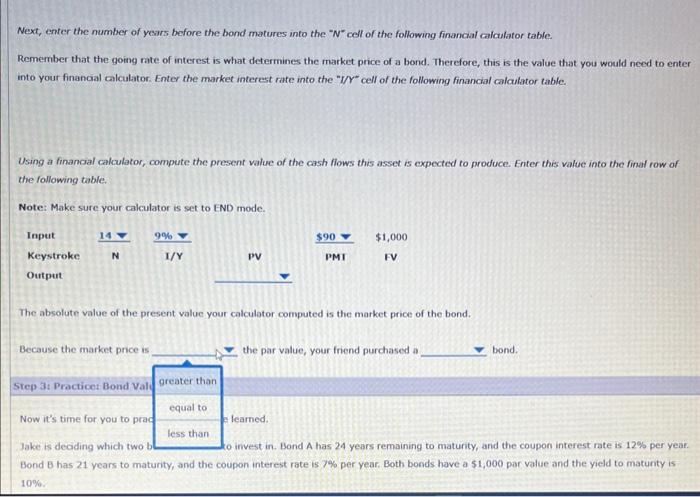

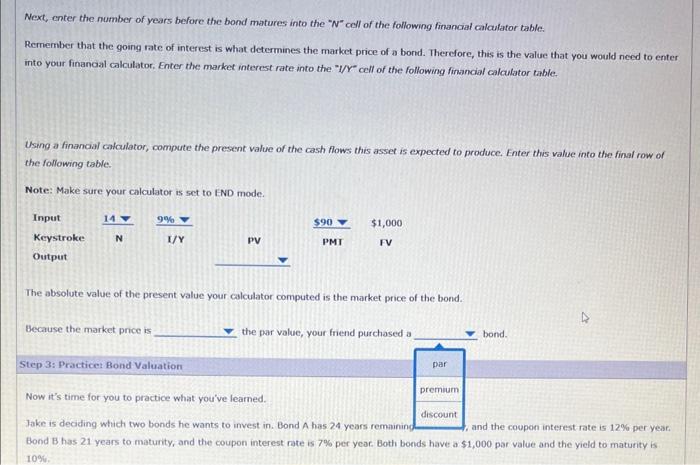

Suppose a friend of yours invested in an outstanding bond with Purple Pottery. The bond has an annual coupon rate of 9%, a remaining matunty of 14 years; and a $1,000 par value. The tharket interest rate is currently 11%. In order to use a financial cakulator to compute how much your friend paid for the bond, you will need to know the following information: Compute the amount of interest pad each ycar by completing the following math derivation. Select this same vahue from the "pMI drop down menu found in the following financial calculator table. AmountofInterest=CouponRateParValue=3909%%5,000=$ Next, enter the number of years before the bond matures into the "N" cell of the following financial calculator table. Remember that the going rate of interest is what determines the market price of a bond. Therefore, this is the value that you would need to enter into your financial calculator. Fnter the market interest rate mito the "l/" ceff of the foulowing financial calculator table. Next, enter the number of years before the bond matures into the " N " cell of the following financial calculator table. Remember that the going rate of interest is what determines the market price of a bond. Therefore, this is the value that you would need to enter into your financal calculator. Enter the market interest rate into the "I/Y" cell of the following financal calculator table. Using a finanoal calculator, compute the present value of the cash flows this asset is expected to produce. Enter this value into the final row of the following table. Note: Make sure your calculator is set to END mode. The absolute value of the present value y omputed is the market price of the bond. Because the market price is alue, your friend purchased a bond Step 3: Practicet Bond Valuation Now it's time for you to practice what you've leamed. Jake is deoding which two bonds he wants to invest in. Bond A has 24 years remaining to maturty, and the coupon interest rate is 12% per year. Bond B has 21 years to maturty, and the coupon interest rate is 7% per year. Both bonds have a $1,000 par value and the yield to maturity is Next, enter the number of yesars before the bond matures into the " N " cell of the following financial calculator table. Remember that the going rate of interest is what determines the market price of a bond. Therefore, this is the value that you would need to enter into yout financal calculator. Enter the market interest rate into the "I/Y" cell of the following finarial calculator table. Using a financal cakculator, compute the present value of the cash fiows this asset is expected to produce. Enter this value into the final row of the following table. Note: Make sure your calculator is set to END mode. The absolute value of the present value your calculator computed is the market price of the bond. Because the market price is the par value, your friend purchased a bond. Step it Practicet Bond Vali Now it's time for you to prac A learned. Jake is deciding which two b 0 invest in. Bond A has 24 years remaining to maturity, and the coupon interest rate is 12% per year. Bond B has 21 years to maturity, and the coupon interest rate is 7% per year. Both bonds have a 51,000 par value and the yield to maturity is 10% Next, cnter the number of years before the bond matures into the " N " cell of the following financiat calculator table. Remember that the going rate of interest is what determines the market price of a bornd. Therefore, this is the value that you would need to enter into your financal calculator. Enter the market interest rate into the "1/Y" cell of the following financial cakculator table. Using a financial calculator, compute the present value of the cash flows this asset is expected to produce. Enter this value into the final row of the following table. Note: Make sure your calculator is set to END mode. The absolute value of the present value your calculator computed is the market price of the bond. Because the market price is the par value, your friend purchased a bond. Now it's time for you to practice what you've learned. Jake is deciding which two bonds he wants to invest in. Bond A has. 24 years remainingadiscount Bond B has 21 years to maturity, and the coupon interest rate is 7% per year. Both bonds have a $1,000 par value and the yield to maturity is