Answered step by step

Verified Expert Solution

Question

1 Approved Answer

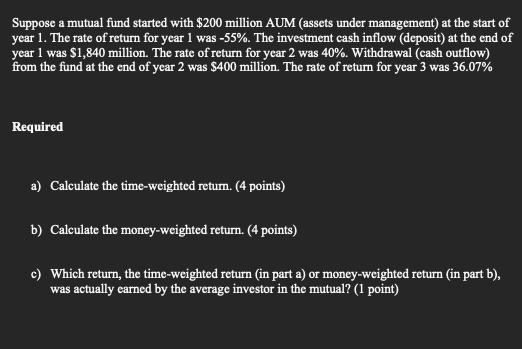

Suppose a mutual fund started with $200 million AUM (assets under management) at the start of year 1. The rate of return for year

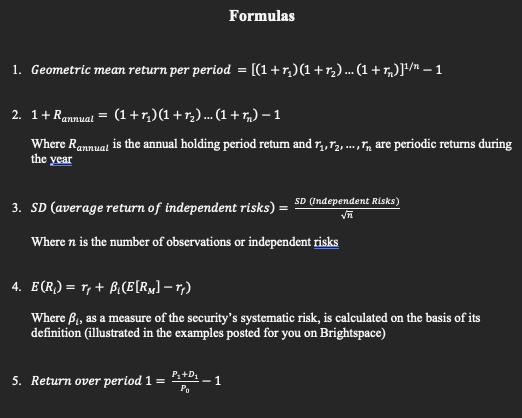

Suppose a mutual fund started with $200 million AUM (assets under management) at the start of year 1. The rate of return for year I was -55%. The investment cash inflow (deposit) at the end of year 1 was $1,840 million. The rate of return for year 2 was 40%. Withdrawal (cash outflow) from the fund at the end of year 2 was $400 million. The rate of return for year 3 was 36.07% Required a) Calculate the time-weighted return. (4 points) b) Calculate the money-weighted return. (4 points) c) Which return, the time-weighted return (in part a) or money-weighted return (in part b), was actually earned by the average investor in the mutual? (1 point) Formulas 1. Geometric mean return per period = [(1 + r) (1 + r) ... (1 + r)]/ 1 2. 1 + Rannual = (1+r) (1 + r ) ... (1 + r) 1 Where Rannual is the annual holding period return and 7, 72,...,, are periodic returns during the year 3. SD (average return of independent risks) = SD (Independent Risks) n Where n is the number of observations or independent risks 4. E(R) = Ty + B(E[RM] T) Where B, as a measure of the security's systematic risk, is calculated on the basis of its definition (illustrated in the examples posted for you on Brightspace) 5. Return over period 1 = -1 P + D Po

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the timeweighted return The timeweighted return measures the average return earned by ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started