Answered step by step

Verified Expert Solution

Question

1 Approved Answer

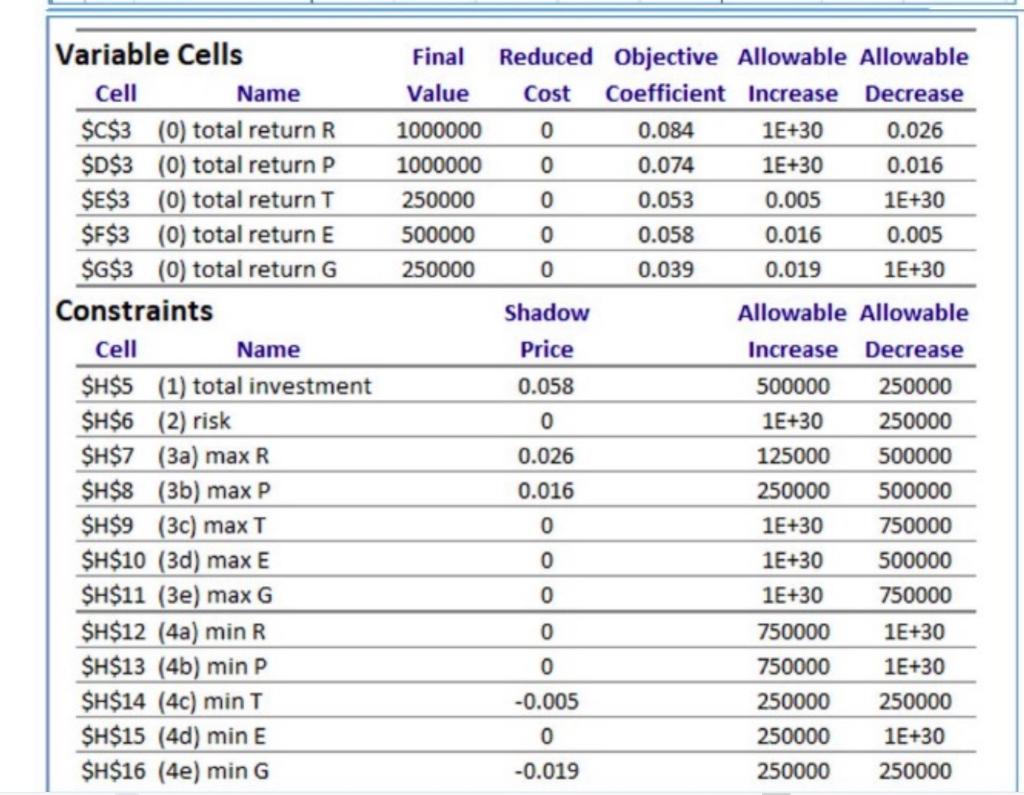

Suppose a new investment instrument F with an annual rate of return of 0.063 and a risk of 2 becomes available and the planner invests

Suppose a new investment instrument F with an annual rate of return of 0.063 and a risk of 2 becomes available and the planner invests 100000(of the 3 million) in this investment instrument. Then the optimal total return decreases ( a negative number) or increase ( a positive number) by: ___

Final Reduced Objective Allowable Allowable Value Cost Coefficient Increase Decrease 1000000 0 0.084 1E+30 0.026 1000000 0 0.074 1E+30 0.016 250000 o 0.053 0.005 1E+30 500000 0 0.058 0.016 0.005 250000 0 0.039 0.019 1E+30 Shadow Price Allowable Allowable Increase Decrease Variable Cells Cell Name $C$3 (0) total return R $D$3 (0) total return P $E$3 (0) total return T $F$3 (0) total return E $G$3 (0) total return G Constraints Cell Name $H$5 (1) total investment SH$6 (2) risk $H$7 (3a) max R SH$8 (3b) max P $H$9 (3c) max T $H$10 (3d) max E $H$11 (3e) max G $H$12 (4a) min R $H$13 (4b) min P $H$14 (4c) mint $H$15 (4d) min E $H$16 (4e) min G 0.058 0 0.026 0.016 0 500000 1E+30 125000 250000 1E+30 1E+30 1E+30 750000 750000 250000 250000 250000 250000 250000 500000 500000 750000 500000 750000 0 0 0 0 1E+30 1E+30 250000 -0.005 0 -0.019 1E+30 250000 Final Reduced Objective Allowable Allowable Value Cost Coefficient Increase Decrease 1000000 0 0.084 1E+30 0.026 1000000 0 0.074 1E+30 0.016 250000 o 0.053 0.005 1E+30 500000 0 0.058 0.016 0.005 250000 0 0.039 0.019 1E+30 Shadow Price Allowable Allowable Increase Decrease Variable Cells Cell Name $C$3 (0) total return R $D$3 (0) total return P $E$3 (0) total return T $F$3 (0) total return E $G$3 (0) total return G Constraints Cell Name $H$5 (1) total investment SH$6 (2) risk $H$7 (3a) max R SH$8 (3b) max P $H$9 (3c) max T $H$10 (3d) max E $H$11 (3e) max G $H$12 (4a) min R $H$13 (4b) min P $H$14 (4c) mint $H$15 (4d) min E $H$16 (4e) min G 0.058 0 0.026 0.016 0 500000 1E+30 125000 250000 1E+30 1E+30 1E+30 750000 750000 250000 250000 250000 250000 250000 500000 500000 750000 500000 750000 0 0 0 0 1E+30 1E+30 250000 -0.005 0 -0.019 1E+30 250000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started