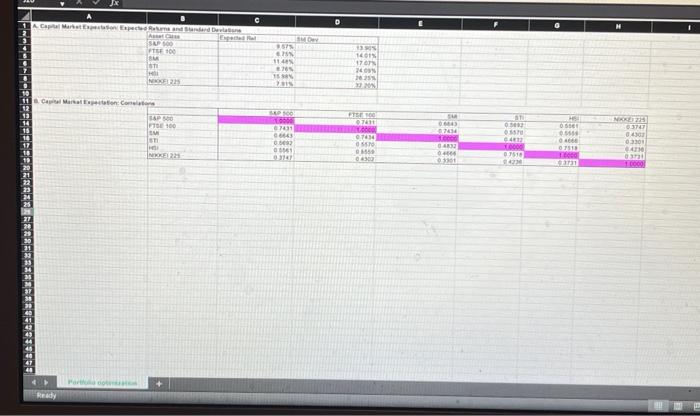

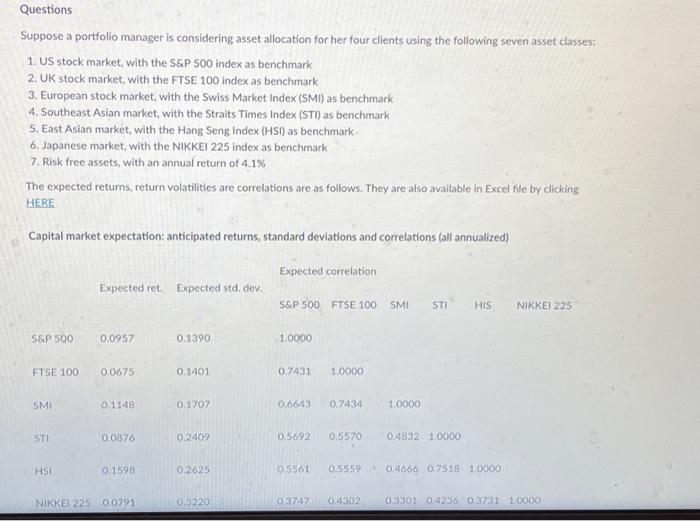

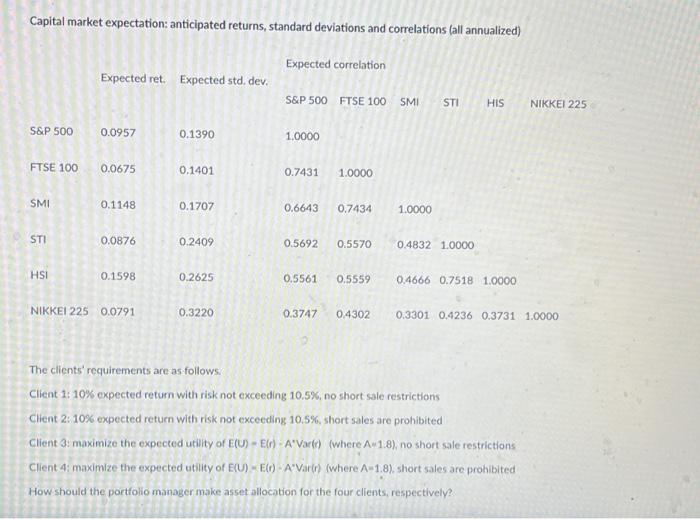

Suppose a portfolio manager is considering asset allocation for her four clients using the following seven asset classes: 1. US stock market, with the S\&P 500 index as benchmark 2. UK stock market, with the FTSE 100 index as benchmark 3. European stock market, with the Swiss Market Index (SMI) as benchmark 4. Southeast Asian market, with the Straits Times Index (STI) as benchmark 5. East Asian market, with the Hang Seng Index (HSI) as benchmark 6. Japanese market, with the NIKKEI 225 index as benchmark 7. Risk free assets, with an annual return of 4.1% The expected returns, return volatilities are correlations are as follows. They are also avaliable in Excel fle by clicking HERE Capital market expectation: anticipated returns, standard deviations and correlations (all annualized) Capital market expectation: anticipated returns, standard deviations and correlations (all annualized) The clients' requirements are as follows. Client 1: 10% expected return with risk not exceeding 10.5\%, no short sale restrictions Client 2: 10% expected return with risk not exceeding 10.5%, short sales are prohibited Client 3: maximize the expected utility of E(U)=E(r)AVa(t) (where Aw1.8 ) no short sale restrictions Client 4: maximize the expected utility of E(U)=E(r) - A*Var(r) (where A1.8), short sales are prohibited How should the portfolio manager make asset allocation for the four clients, respectively? Suppose a portfolio manager is considering asset allocation for her four clients using the following seven asset classes: 1. US stock market, with the S\&P 500 index as benchmark 2. UK stock market, with the FTSE 100 index as benchmark 3. European stock market, with the Swiss Market Index (SMI) as benchmark 4. Southeast Asian market, with the Straits Times Index (STI) as benchmark 5. East Asian market, with the Hang Seng Index (HSI) as benchmark 6. Japanese market, with the NIKKEI 225 index as benchmark 7. Risk free assets, with an annual return of 4.1% The expected returns, return volatilities are correlations are as follows. They are also avaliable in Excel fle by clicking HERE Capital market expectation: anticipated returns, standard deviations and correlations (all annualized) Capital market expectation: anticipated returns, standard deviations and correlations (all annualized) The clients' requirements are as follows. Client 1: 10% expected return with risk not exceeding 10.5\%, no short sale restrictions Client 2: 10% expected return with risk not exceeding 10.5%, short sales are prohibited Client 3: maximize the expected utility of E(U)=E(r)AVa(t) (where Aw1.8 ) no short sale restrictions Client 4: maximize the expected utility of E(U)=E(r) - A*Var(r) (where A1.8), short sales are prohibited How should the portfolio manager make asset allocation for the four clients, respectively