Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a risk neutral agent has $100,000 today that he wants to save for one year. Compare the following three savings plans. Bank A

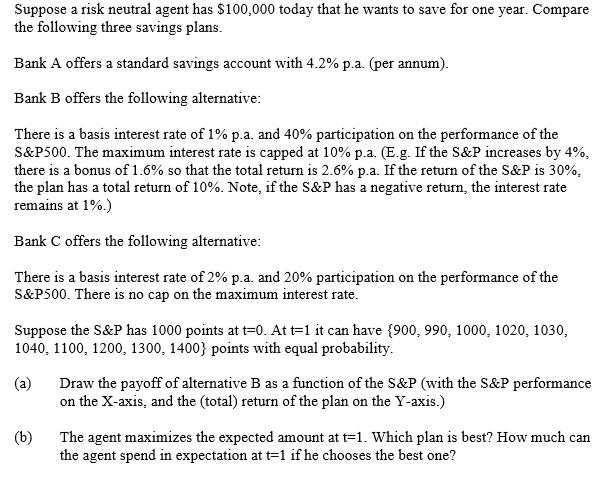

Suppose a risk neutral agent has $100,000 today that he wants to save for one year. Compare the following three savings plans. Bank A offers a standard savings account with 4.2% p.a. (per annum). Bank B offers the following alternative: There is a basis interest rate of 1% p.a. and 40% participation on the performance of the S&P500. The maximum interest rate is capped at 10% p.a. (E.g. If the S&P increases by 4%, there is a bonus of 1.6% so that the total return is 2.6% p.a. If the return of the S&P is 30%, the plan has a total return of 10%. Note, if the S&P has a negative return, the interest rate remains at 1%.) Bank C offers the following alternative: There is a basis interest rate of 2% p.a. and 20% participation on the performance of the S&P500. There is no cap on the maximum interest rate. Suppose the S&P has 1000 points at t-0. At t=1 it can have {900, 990, 1000, 1020, 1030, 1040, 1100, 1200, 1300, 1400} points with equal probability. (a) Draw the payoff of alternative B as a function of the S&P (with the S&P performance on the X-axis, and the (total) return of the plan on the Y-axis.) (b) The agent maximizes the expected amount at t=1. Which plan is best? How much can the agent spend in expectation at t=1 if he chooses the best one?

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a The payoff of Bank B as a function of SP performance is Xaxis ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started