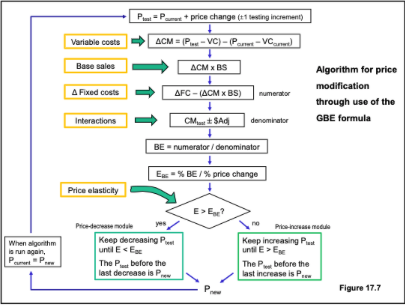

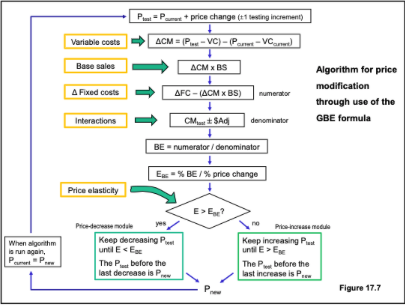

Suppose a small grocery store was selling 300 units per week of particular SKU priced at $4.50. Further, suppose that this item's VCs were $3.60, there were incremental labor costs of $2 to implement a price change on this item, and this item warranted a contribution- margin adjustment for complements of $0.75. (a) Given this information, use the GBE algorithm (illustrated in Figure 17.7) to calculate the EBE for a 5% price decrease. (b) If the price elasticity module of the algorithm indicated that the market's price elasticity was -2.0, would the price-increase module be activated or the price-decrease module? Explain your reasoning. (c) Assuming your answer to Part (b), describe the steps that would be taken by the GBE algorithm to arrive at a profit-maximizing price in this situation. P= P + price change (t1 testing increment) Variable costs ACM = (P. - VC) - (Pont-VC Base sales ACM X BS A Fixed costs numerator AFC - (ACM X BS) + CM SA Algorithm for price modification through use of the GBE formula Interactions denominator BE-numerator / denominator Ex-%BE/% price change Price elasticity EE? When algorithm is run again, PartP... Pridade yes Keep decreasing P. until EE The P... before the last decrease is P Price-norsenedule Keep increasing Pu until E>EX The Pbefore the last increase is P. P Figure 17.7 Suppose a small grocery store was selling 300 units per week of particular SKU priced at $4.50. Further, suppose that this item's VCs were $3.60, there were incremental labor costs of $2 to implement a price change on this item, and this item warranted a contribution- margin adjustment for complements of $0.75. (a) Given this information, use the GBE algorithm (illustrated in Figure 17.7) to calculate the EBE for a 5% price decrease. (b) If the price elasticity module of the algorithm indicated that the market's price elasticity was -2.0, would the price-increase module be activated or the price-decrease module? Explain your reasoning. (c) Assuming your answer to Part (b), describe the steps that would be taken by the GBE algorithm to arrive at a profit-maximizing price in this situation. P= P + price change (t1 testing increment) Variable costs ACM = (P. - VC) - (Pont-VC Base sales ACM X BS A Fixed costs numerator AFC - (ACM X BS) + CM SA Algorithm for price modification through use of the GBE formula Interactions denominator BE-numerator / denominator Ex-%BE/% price change Price elasticity EE? When algorithm is run again, PartP... Pridade yes Keep decreasing P. until EE The P... before the last decrease is P Price-norsenedule Keep increasing Pu until E>EX The Pbefore the last increase is P. P Figure 17.7