Question

Suppose ABC Corporation has an obligation to pay $10,000 and $40,000 at the end of 5 years and 7 years respectively. In order to meet

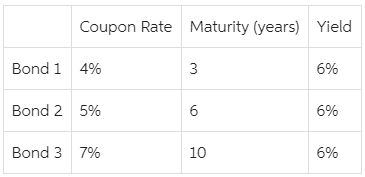

Suppose ABC Corporation has an obligation to pay $10,000 and $40,000 at the end of 5 years and 7 years respectively. In order to meet this obligation, it plans to invest money by selecting from the following three bonds:

All bonds have the same face value $1000. Assume that the annual rate of interest to be used in all calculations is 6%. Consider semi-annual compounding. (Keep your answers to 2 decimal places, e.g. xxx.12.)

(a) Find the present value and duration of the obligation.

(b) Suppose the Corporation decides to use bonds 2 and 3. Denote by V 2 and V 3 to be the amounts of money to be invested in the two bonds, respectively. To get an immunized portfolio, write down appropriate equations in V 2 and V 3 first, and solve for V 2 and V 3.

Coupon Rate Maturity (years) Yield Bond 1 4% Bond 2 5% Bond 3 7% 3 6 10 6% 6% 6%

Step by Step Solution

3.23 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Let say X is invested in Bond V2 and 1 X invested in Bond V3 then Particulars Cash Flow Weight C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started