Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose all assumptions of the Capital Asset Pricing Model are true. Consider two firms A and B, which invest in the same type of risky

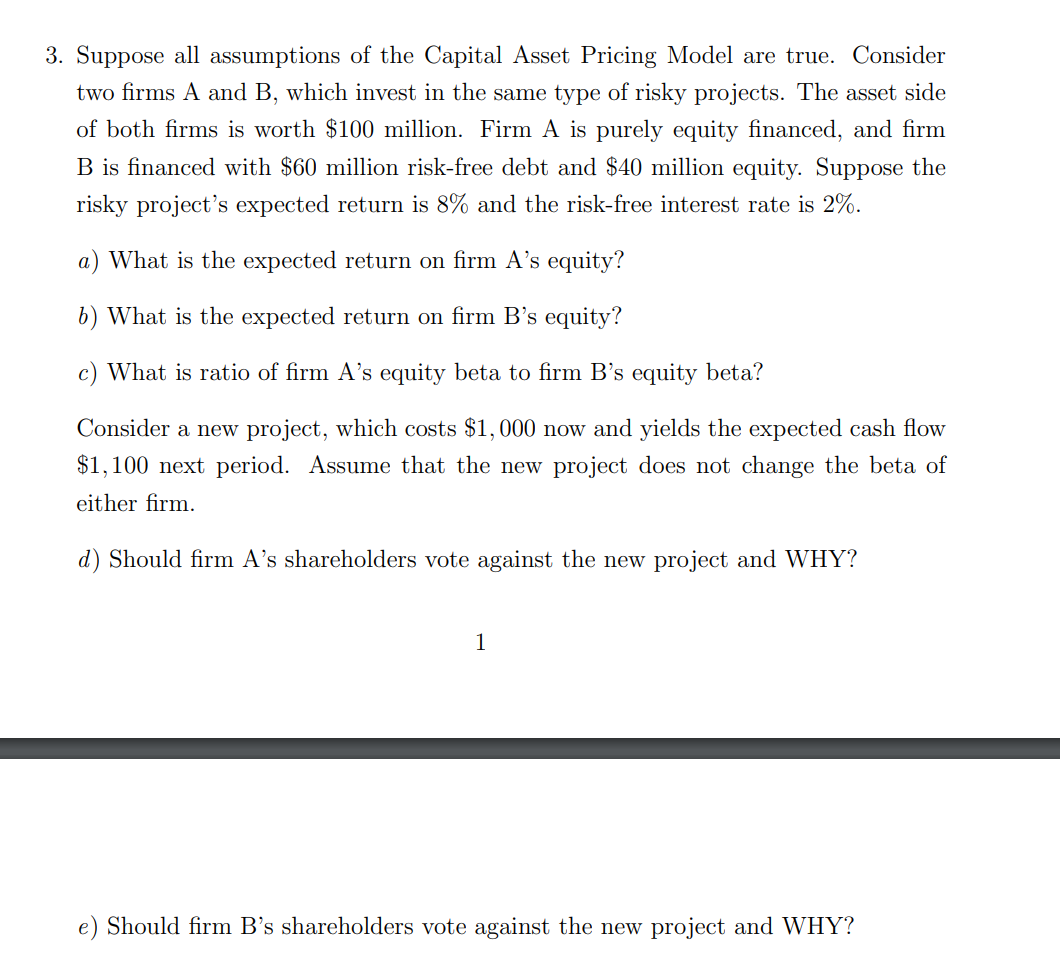

Suppose all assumptions of the Capital Asset Pricing Model are true. Consider two firms A and B, which invest in the same type of risky projects. The asset side of both firms is worth $100 million. Firm A is purely equity financed, and firm B is financed with $60 million risk-free debt and $40 million equity. Suppose the risky project's expected return is 8% and the risk-free interest rate is 2%. a) What is the expected return on firm A's equity? b) What is the expected return on firm B's equity? c) What is ratio of firm A's equity beta to firm B's equity beta? Consider a new project, which costs $1,000 now and yields the expected cash flow $1,100 next period. Assume that the new project does not change the beta of either firm. d) Should firm A's shareholders vote against the new project and WHY? 1 e) Should firm B's shareholders vote against the new project and WHY

Suppose all assumptions of the Capital Asset Pricing Model are true. Consider two firms A and B, which invest in the same type of risky projects. The asset side of both firms is worth $100 million. Firm A is purely equity financed, and firm B is financed with $60 million risk-free debt and $40 million equity. Suppose the risky project's expected return is 8% and the risk-free interest rate is 2%. a) What is the expected return on firm A's equity? b) What is the expected return on firm B's equity? c) What is ratio of firm A's equity beta to firm B's equity beta? Consider a new project, which costs $1,000 now and yields the expected cash flow $1,100 next period. Assume that the new project does not change the beta of either firm. d) Should firm A's shareholders vote against the new project and WHY? 1 e) Should firm B's shareholders vote against the new project and WHY Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started