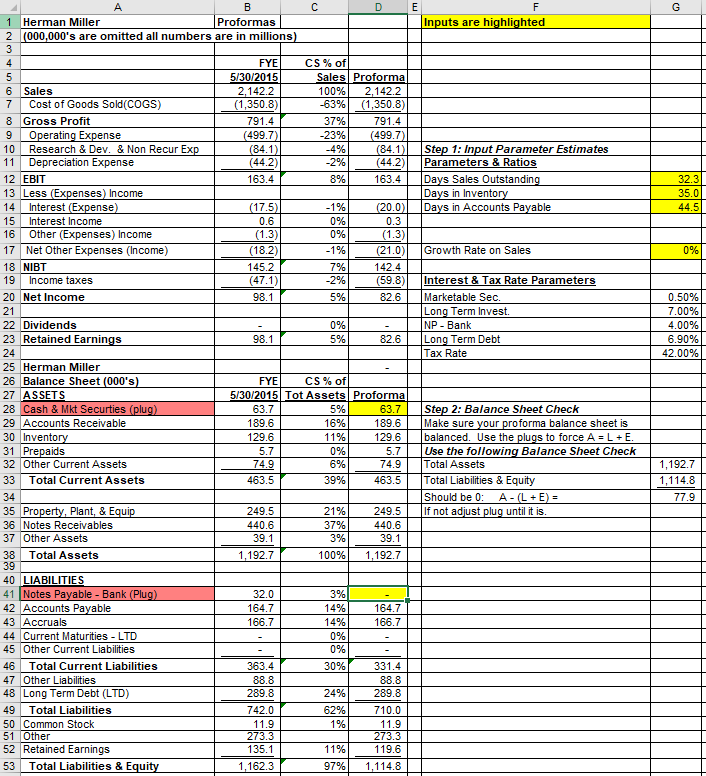

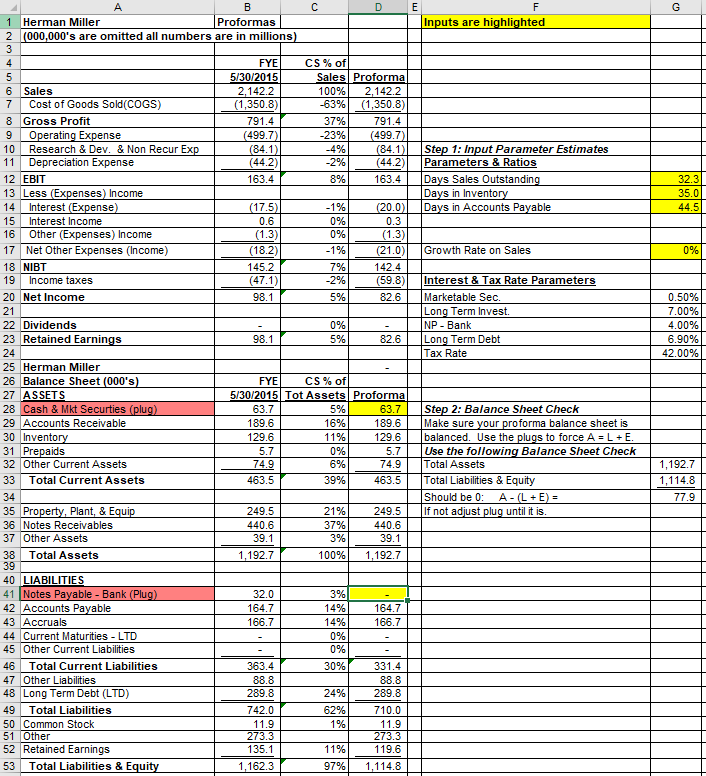

Suppose all parameter estimates are based on last year's results, except Sales are expected to grow at 25%. What would be the impact on Net Income and the Plugs? (Note omit 000,000's and one of the plugs is always zero.)

| Cash & Marketable Securities = | |

| Notes Payable Bank = | | |

| Proforma Net Income = | |

Assuming MLHR is expecting a 25% increase in Sales and they have the plant capacity, what should they do now to prepare for this?

G 32.3 35.0 44.5 0% 0.50% 7.00% 4.00% 6.90% 42.00% i A B D E F 1 Herman Miller Proformas Inputs are highlighted 2 (000,000's are omitted all numbers are in millions) 3 4 FYE CS% of 5 5/30/2015 Sales Proforma 6 Sales 2,142.2 100% 2,142.2 7 Cost of Goods Sold (COGS) (1,350.8) -63% (1,350.8) 8 Gross Profit 791.4 37% 791.4 9 Operating Expense (499.7) -23% (499.7) 10 Research & Dev. & Non Recur Exp (84.1) -4% (84.1) Step 1: Input Parameter Estimates 11 Depreciation Expense (44.2) -2% (44.2) Parameters & Ratios 12 EBIT 163.4 8% 163.4 Days Sales Outstanding 13 Less (Expenses) Income Days in Inventory 14 Interest (Expense) (17.5) -1% (20.0) Days in Accounts Payable 15 Interest Income 0.6 0% 0.3 16 Other (Expenses) Income (1.3) 0% (1.3) 17 Net Other Expenses (Income) (18.2) -1% (21.0) Growth Rate on Sales 18 NIBT 145.2 7% 142.4 19 Income taxes (47.1) -2% (59.8) Interest & Tax Rate Parameters 20 Net Income 98.1 5% 82.6 Marketable Sec. 21 Long Term Invest. 22 Dividends 0% NP-Bank 23 Retained Earnings 98.1 5% 82.6 Long Term Debt 24 Tax Rate 25 Herman Miller 26 Balance Sheet (000's) FYE CS% of 27 ASSETS 5/30/2015 Tot Assets Proforma 28 Cash & Mkt Securties (plug) 63.7 5% 63.7 Step 2: Balance Sheet Check 29 Accounts Receivable 189.6 16% 189.6 Make sure your proforma balance sheet is 30 Inventory 129.6 11% 129.6 balanced. Use the plugs force A = L + E. 31 Prepaids 5.7 0% 5.7 Use the following Balance Sheet Check 32 Other Current Assets 74.9 6% 74.9 Total Assets 33 Total Current Assets 463.5 39% 463.5 Total Liabilities & Equity 34 Should be 0: A - (L + E) = 35 Property, Plant, & Equip 249.5 21% 249.5 If not adjust plug until it is. 36 Notes Receivables 440.6 37% 440.6 37 Other Assets 39.1 3% 39.1 38 Total Assets 1,192.7 100% 1,192.7 39 40 LIABILITIES 41 Notes Payable - Bank (Plug) 32.0 3% 42 Accounts Payable 164.7 14% 164.7 43 Accruals 166.7 14% 166.7 44 Current Maturities - LTD 45 Other Current Liabilities 0% 46 Total Current Liabilities 363.4 30% 331.4 47 Other Liabilities 88.8 88.8 48 Long Term Debt (LTD) 289.8 24% 289.8 49 Total Liabilities 742.0 62% 710.0 50 Common Stock 11.9 1% 11.9 51 Other 273.3 273.3 52 Retained Earnings 135.1 11% 119.6 53 Total Liabilities & Equity 1,162.3 97% 1,114.8 1,192.7 1,114.8 77.9 0% G 32.3 35.0 44.5 0% 0.50% 7.00% 4.00% 6.90% 42.00% i A B D E F 1 Herman Miller Proformas Inputs are highlighted 2 (000,000's are omitted all numbers are in millions) 3 4 FYE CS% of 5 5/30/2015 Sales Proforma 6 Sales 2,142.2 100% 2,142.2 7 Cost of Goods Sold (COGS) (1,350.8) -63% (1,350.8) 8 Gross Profit 791.4 37% 791.4 9 Operating Expense (499.7) -23% (499.7) 10 Research & Dev. & Non Recur Exp (84.1) -4% (84.1) Step 1: Input Parameter Estimates 11 Depreciation Expense (44.2) -2% (44.2) Parameters & Ratios 12 EBIT 163.4 8% 163.4 Days Sales Outstanding 13 Less (Expenses) Income Days in Inventory 14 Interest (Expense) (17.5) -1% (20.0) Days in Accounts Payable 15 Interest Income 0.6 0% 0.3 16 Other (Expenses) Income (1.3) 0% (1.3) 17 Net Other Expenses (Income) (18.2) -1% (21.0) Growth Rate on Sales 18 NIBT 145.2 7% 142.4 19 Income taxes (47.1) -2% (59.8) Interest & Tax Rate Parameters 20 Net Income 98.1 5% 82.6 Marketable Sec. 21 Long Term Invest. 22 Dividends 0% NP-Bank 23 Retained Earnings 98.1 5% 82.6 Long Term Debt 24 Tax Rate 25 Herman Miller 26 Balance Sheet (000's) FYE CS% of 27 ASSETS 5/30/2015 Tot Assets Proforma 28 Cash & Mkt Securties (plug) 63.7 5% 63.7 Step 2: Balance Sheet Check 29 Accounts Receivable 189.6 16% 189.6 Make sure your proforma balance sheet is 30 Inventory 129.6 11% 129.6 balanced. Use the plugs force A = L + E. 31 Prepaids 5.7 0% 5.7 Use the following Balance Sheet Check 32 Other Current Assets 74.9 6% 74.9 Total Assets 33 Total Current Assets 463.5 39% 463.5 Total Liabilities & Equity 34 Should be 0: A - (L + E) = 35 Property, Plant, & Equip 249.5 21% 249.5 If not adjust plug until it is. 36 Notes Receivables 440.6 37% 440.6 37 Other Assets 39.1 3% 39.1 38 Total Assets 1,192.7 100% 1,192.7 39 40 LIABILITIES 41 Notes Payable - Bank (Plug) 32.0 3% 42 Accounts Payable 164.7 14% 164.7 43 Accruals 166.7 14% 166.7 44 Current Maturities - LTD 45 Other Current Liabilities 0% 46 Total Current Liabilities 363.4 30% 331.4 47 Other Liabilities 88.8 88.8 48 Long Term Debt (LTD) 289.8 24% 289.8 49 Total Liabilities 742.0 62% 710.0 50 Common Stock 11.9 1% 11.9 51 Other 273.3 273.3 52 Retained Earnings 135.1 11% 119.6 53 Total Liabilities & Equity 1,162.3 97% 1,114.8 1,192.7 1,114.8 77.9 0%