Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose all people in RiverCity own identical cars worth $80,000 apiece. During La Nina years, RiverCity is hit by cyclones and receives heavy rains

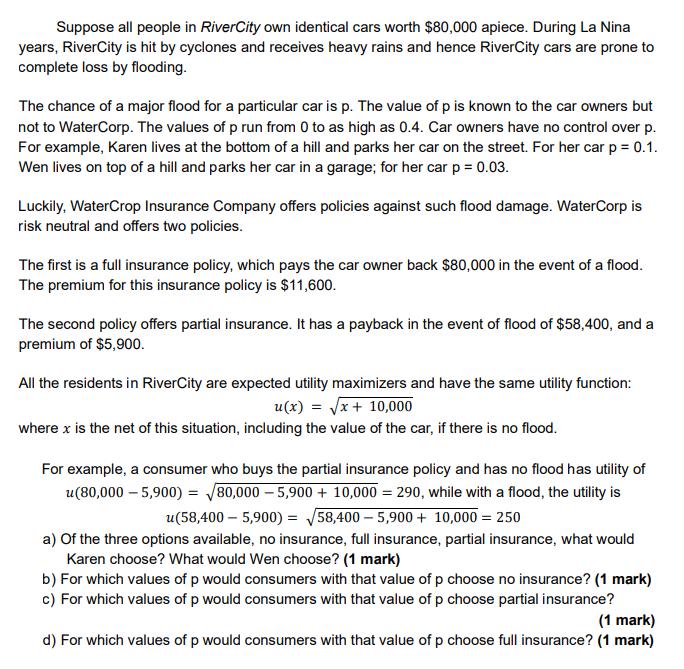

Suppose all people in RiverCity own identical cars worth $80,000 apiece. During La Nina years, RiverCity is hit by cyclones and receives heavy rains and hence RiverCity cars are prone to complete loss by flooding. The chance of a major flood for a particular car is p. The value of p is known to the car owners but not to WaterCorp. The values of p run from 0 to as high as 0.4. Car owners have no control over p. For example, Karen lives at the bottom of a hill and parks her car on the street. For her car p = 0.1. Wen lives on top of a hill and parks her car in a garage; for her car p = 0.03. Luckily, WaterCrop Insurance Company offers policies against such flood damage. WaterCorp is risk neutral and offers two policies. The first is a full insurance policy, which pays the car owner back $80,000 in the event of a flood. The premium for this insurance policy is $11,600. The second policy offers partial insurance. It has a payback in the event of flood of $58,400, and a premium of $5,900. All the residents in RiverCity are expected utility maximizers and have the same utility function: u(x)=x + 10,000 where x is the net of this situation, including the value of the car, if there is no flood. For example, a consumer who buys the partial insurance policy and has no flood has utility of u(80,000 -5,900) = 80,000 -5,900 + 10,000 = 290, while with a flood, the utility is u(58,400-5,900) = 58,400-5,900 + 10,000 = 250 a) Of the three options available, no insurance, full insurance, partial insurance, what would Karen choose? What would Wen choose? (1 mark) b) For which values of p would consumers with that value of p choose no insurance? (1 mark) c) For which values of p would consumers with that value of p choose partial insurance? (1 mark) d) For which values of p would consumers with that value of p choose full insurance? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step by step explanation a K...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started