Question

Suppose Amazon has decided to introduce the Echo III. Before they launch the Echo III, they conducted an analysis to see if the Echo II

Suppose Amazon has decided to introduce the Echo III. Before they launch the Echo III, they conducted an analysis to see if the Echo II would be a desirable investment. The company estimated that it would sell 10 million Echo IIIs per year at a price of $250 for the next six years.

Suppose Amazon has decided to introduce the Echo III. Before they launch the Echo III, they conducted an analysis to see if the Echo II would be a desirable investment. The company estimated that it would sell 10 million Echo IIIs per year at a price of $250 for the next six years.

The initial capital outlay is determined to be $1.25 billion and a $600 million outlay in net working capital would also be required.

Assume that the equipment used will be depreciated using the MACRS 7 year schedule and that the equipment has a salvage value of zero. At the end of year 6, the equipment will be sold for its book value. Also, assume that that the tax rate is 25%.

1. Using information from Amazons financial statements (you may want to use Morningstar.com or some other online site) estimate the operating cash flows from the project. Make any simplifying assumptions that are necessary to produce the estimate.

2. If the cost of capital is 12%, compute the NPV and IRR for the project. Test the sensitivity of NPV to changes in the cost of capital by increasing the WACC by 1%.

3. Test the sensitivity of NPV and IRR to changes in the growth rate of sales. Use a -2% 0% and 2% growth rate for sales in your analysis. (use the original 12% cost of capital for this part of the assignment).

4. Test the sensitivity of NPV and IRR to changes in the cost of goods sold percentage. Use a percentage that is 2% less than the number you originally estimated to do the computation. Then recalculate using a percentage that is 3% more than you originally estimated. For example, if you used 80%, redo the calculations using 77% and 83%.

please show all work/ formulas in excel*****!!!!

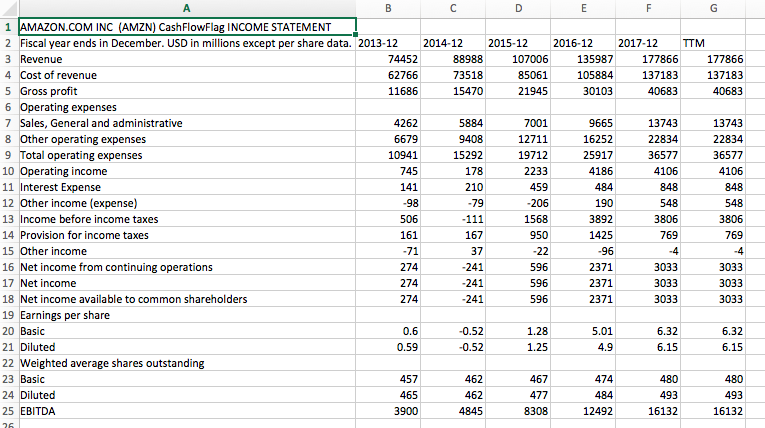

1 AMAZON.COM INC (AMZN) CashFlowFlag INCOME STATEMENT 2 Fiscal year ends in December. USD in millions except per share data. 2013-12 3 Revenue 2014-12 2015-12 2016-12 2017-12 TTM 74452 62766 11686 88988 73518 15470 135987 107006 85061 21945 177866 137183 40683 177866 137183 40683 t of revenue 30103 rating expenses 4262 6679 10941 745 141 7001 12711 19712 13743 22834 36577 4106 13743 22834 36577 4106 7 Sales, General and administrative 16252 25917 4186 er operating expenses 15292 9 Total operating expenses 10 11 Interest Expense 12 Other income (expense) 13 Income before income taxes 14 Provision for income taxes 15 Other income 16 Net income from continuing operations 17 Net income 18 Net income available to common shareholders 19 Earnings per share 20 Basic 21 Diluted 22 Weighted average shares outstanding 23 Basic 24 Diluted 25 EBITDA rating income 459 206 79 190 3892 1425 506 161 71 274 274 274 167 950 769 769 241 241 241 596 596 596 2371 2371 2371 3033 3033 3033 3033 3033 3033 6.32 6.32 0.59 457 474 477 8308 493 16132 462 493 3900 4845 12492 16132 1 AMAZON.COM INC (AMZN) CashFlowFlag INCOME STATEMENT 2 Fiscal year ends in December. USD in millions except per share data. 2013-12 3 Revenue 2014-12 2015-12 2016-12 2017-12 TTM 74452 62766 11686 88988 73518 15470 135987 107006 85061 21945 177866 137183 40683 177866 137183 40683 t of revenue 30103 rating expenses 4262 6679 10941 745 141 7001 12711 19712 13743 22834 36577 4106 13743 22834 36577 4106 7 Sales, General and administrative 16252 25917 4186 er operating expenses 15292 9 Total operating expenses 10 11 Interest Expense 12 Other income (expense) 13 Income before income taxes 14 Provision for income taxes 15 Other income 16 Net income from continuing operations 17 Net income 18 Net income available to common shareholders 19 Earnings per share 20 Basic 21 Diluted 22 Weighted average shares outstanding 23 Basic 24 Diluted 25 EBITDA rating income 459 206 79 190 3892 1425 506 161 71 274 274 274 167 950 769 769 241 241 241 596 596 596 2371 2371 2371 3033 3033 3033 3033 3033 3033 6.32 6.32 0.59 457 474 477 8308 493 16132 462 493 3900 4845 12492 16132Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started