Answered step by step

Verified Expert Solution

Question

1 Approved Answer

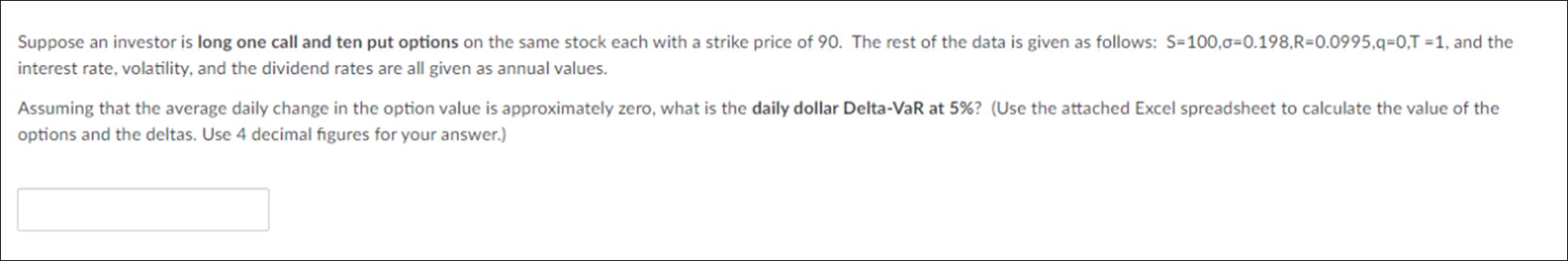

Suppose an investor is long one call and ten put options on the same stock each with a strike price of 90. The rest

Suppose an investor is long one call and ten put options on the same stock each with a strike price of 90. The rest of the data is given as follows: S-100,0-0.198,R-0.0995,q-0,T-1, and the interest rate, volatility, and the dividend rates are all given as annual values. Assuming that the average daily change in the option value is approximately zero, what is the daily dollar Delta-VaR at 5% ? (Use the attached Excel spreadsheet to calculate the value of the options and the deltas. Use 4 decimal figures for your answer.)

Step by Step Solution

★★★★★

3.54 Rating (137 Votes )

There are 3 Steps involved in it

Step: 1

Daily Dollar DeltaVaR at 5 Unfortunately I cannot access or use external files like spreadsheets to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started