Question

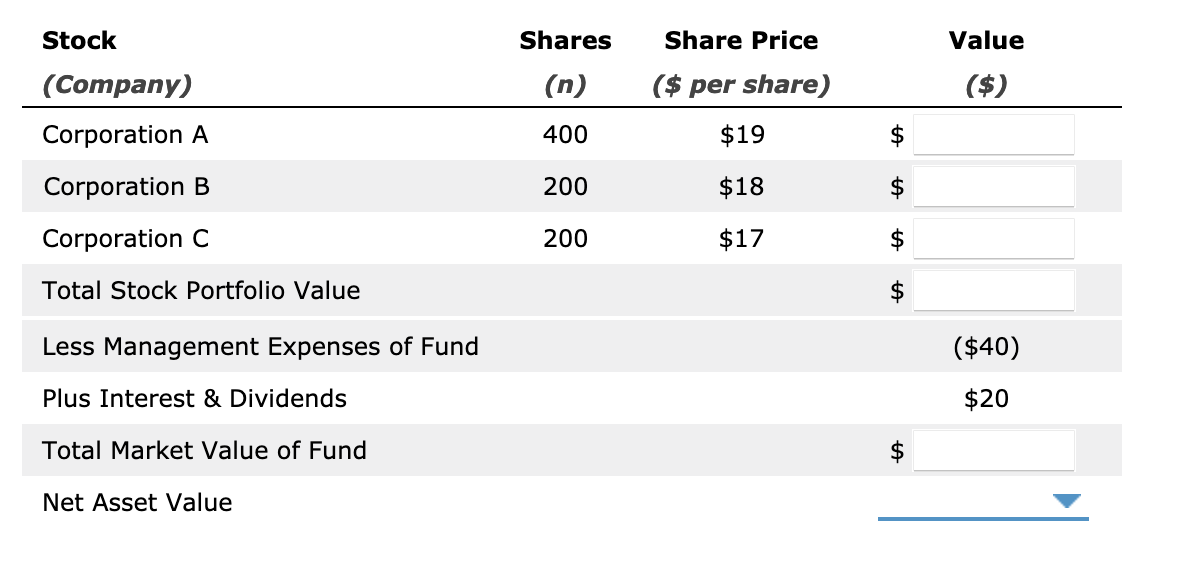

Suppose an open-end mutual fund holds the stocks of three corporations. Assume the fund incurs expenses of $40, while the stocks it holds generate $20

Suppose an open-end mutual fund holds the stocks of three corporations. Assume the fund incurs expenses of $40, while the stocks it holds generate $20 in income. Also assume that the mutual fund has 850 shares outstanding.

Fill in the following table in order to calculate the net asset value (NAV) of the mutual fund.

Many analysts believe the cash holdings of open-end mutual funds can help predict future movements in stock prices.

These analysts argue that if mutual funds hold small amounts of cash, stock prices are more likely to [increase, decrease] in the future.

Stock Value Shares (n) Share Price ($ per share) (Company) ($) Corporation A 400 $19 $ Corporation B 200 $18 Corporation C 200 $17 Total Stock Portfolio Value Less Management Expenses of Fund ($40) Plus Interest & Dividends $20 Total Market Value of Fund $ Net Asset Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started