Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose $APPL is looking to raise capital for a new project. What is SAPPL weighted average cost of capital (WACC) if its beta is

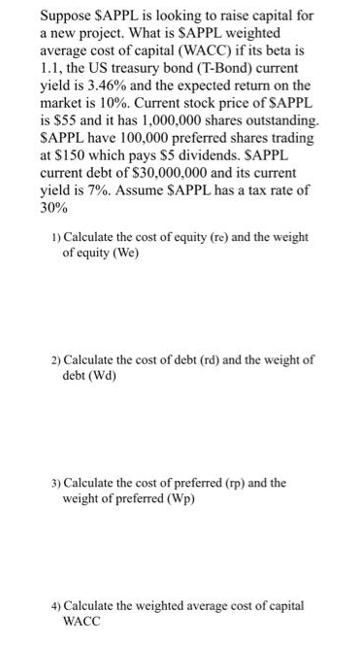

Suppose $APPL is looking to raise capital for a new project. What is SAPPL weighted average cost of capital (WACC) if its beta is 1.1, the US treasury bond (T-Bond) current yield is 3.46% and the expected return on the market is 10%. Current stock price of SAPPL is $55 and it has 1,000,000 shares outstanding. SAPPL have 100,000 preferred shares trading at $150 which pays $5 dividends. SAPPL current debt of $30,000,000 and its current yield is 7%. Assume SAPPL has a tax rate of 30% 1) Calculate the cost of equity (re) and the weight of equity (We) 2) Calculate the cost of debt (rd) and the weight of debt (Wd) 3) Calculate the cost of preferred (rp) and the weight of preferred (Wp) 4) Calculate the weighted average cost of capital WACC

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Cost of Equity re and Weight of Equity We re Rf Rm Rf where Rf Riskfree rate yield on US treasury ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started