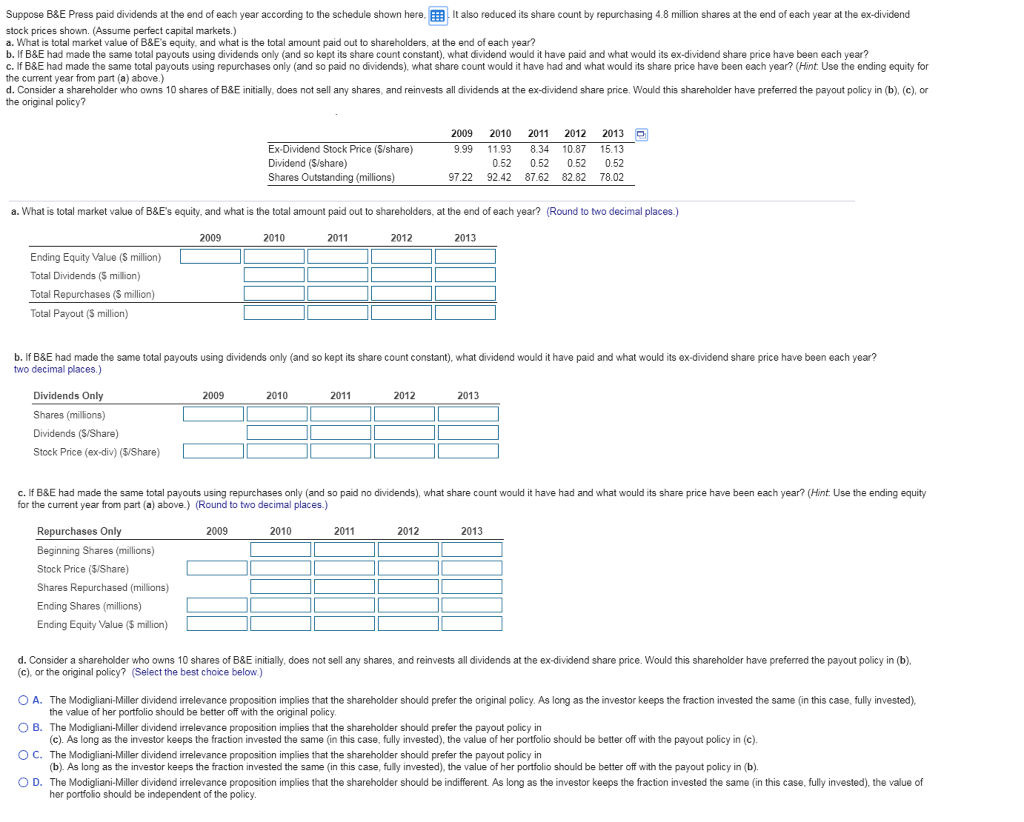

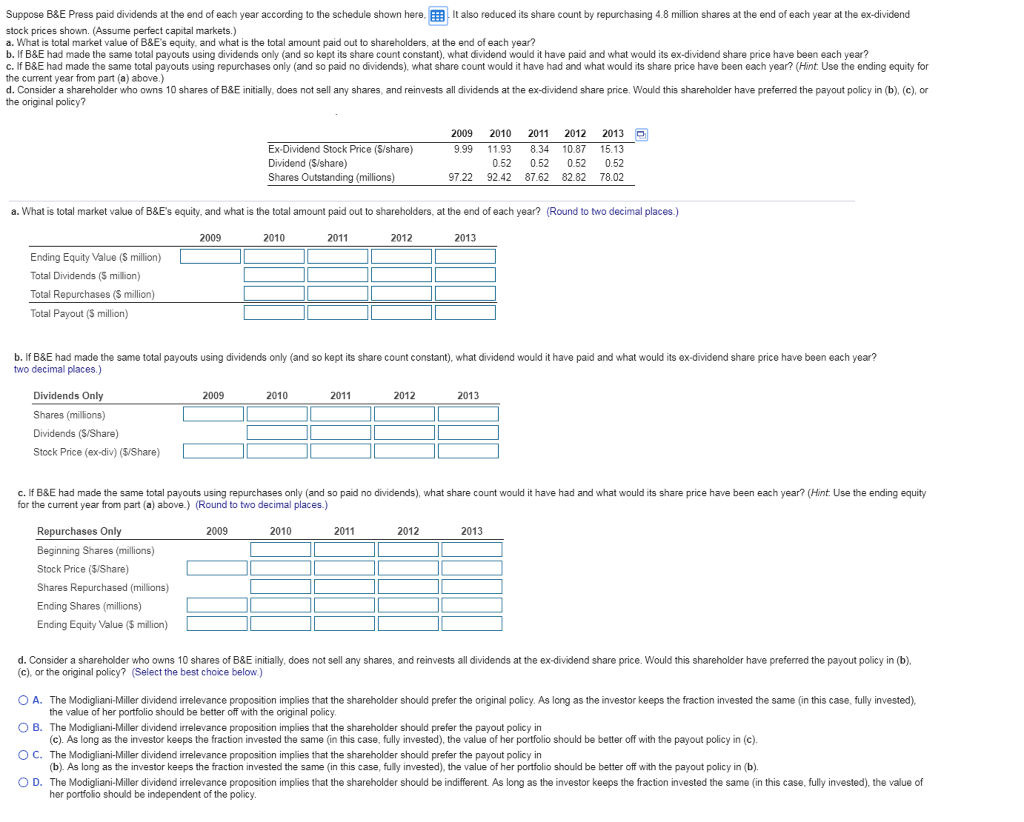

Suppose B&E Press paid dividends at the end of each year according to the schedule shown hereIt also reduced its share count by repurchasing 4.8 million shares at the end of each year at the ex-dividend stock prices shown. (Assume perfect capital markets.) a. What is total market value of B&E's equity, and what is the total amount paid out to shareholders, at the end of each year? b. If B&E had made the same total payouts using dividends only (and so kept its share count constant), what dividend would it have paid and what would its ex-dividend share price have been each year? c. If B&E had made the same total payouts using repurchases only (and so paid no dividends). what share count would it have had and what would its share price have been each year? (Hint Use the ending equity for the current year from part (a) above.) d. Consider a shareholder who owns 10 shares of B&E initially, does not sell any shares, and reinvests all dividends at the ex-dividend share price Would this shareholder have preferred the payout policy in (b), (c), or the original policy? Ex-Dividend Stock Price (S/share) Dividend (S/share) Shares Outstanding (millions) 2009 2010 2011 2012 2013 9.99 11.93 8.34 10.87 15.13 0.52 0.52 0.52 0.52 97.22 92.42 87.62 82.82 78.02 a. What is total market value of B&E's equity, and what is the total amount paid out to shareholders, at the end of each year? Round to two decimal places.) 2009 2010 2011 2012 2013 Ending Equity Value (S million) Total Dividends (S million) Total Repurchases (S million) Total Payout (S million) b.If B&E had made the same total payouts using dividends only (and so kept its share count constant), what dividend would it have paid and what would its ex-dividend share price have been each year? two decimal places.) Dividends Only Shares (millions) Dividends (S/Share) Stock Price (ex-div) (S/Share) 2009 2010 2011 2012 2013 lf B&E had made the same total payouts using repurchases only (and so paid no dividends what share count would it have had and what would its share price have been each year? Hint Use the ending equity for the current year from part (a) above.) (Round to two decimal places.) Repurchases Only Beginning Shares (millions) Stock Price (5/Share) Shares Repurchased (millions) Ending Shares (millions) Ending Equity Value ($ million) 2009 2010 2011 2012 2013 d. Consider a shareholder who owns 10 shares of B&E initially, does not sell any shares, and reinvests all dividends at the ex-dividend share price. Would this shareholder have preferred the payout policy in (b). (c), or the original policy? (Select the best choice below.) O A. The Modigliani-Miller dividend irrelevance proposition implies that the shareholder should prefer the original policy. As long as the investor keeps the fraction invested the same (in this case, fully invested) O B. The Modigliani-Miller dividend irrelevance proposition implies that the shareholder should prefer the payout policy in O C. The Modigliani-Miller dividend irrelevance proposition implies that the shareholder should prefer the payout policy in D. The Modig an iller dividend irrelevance propos on implies that the shareholder should be different. As long as the investor keeps the action invested the same his case fu y invested , the value o the value of her portfolio should be better off with the original policy (c). As long as the investor keeps the fraction invested the same (in this case, fully invested), the value of her portfolio should be better off with the payout policy in (c). (b). As long as the investor keeps the fraction invested the same (in this case, fully invested), the value of her portfolio should be better off with the payout policy in (b) her portfolio should be independent of the policy