Answered step by step

Verified Expert Solution

Question

1 Approved Answer

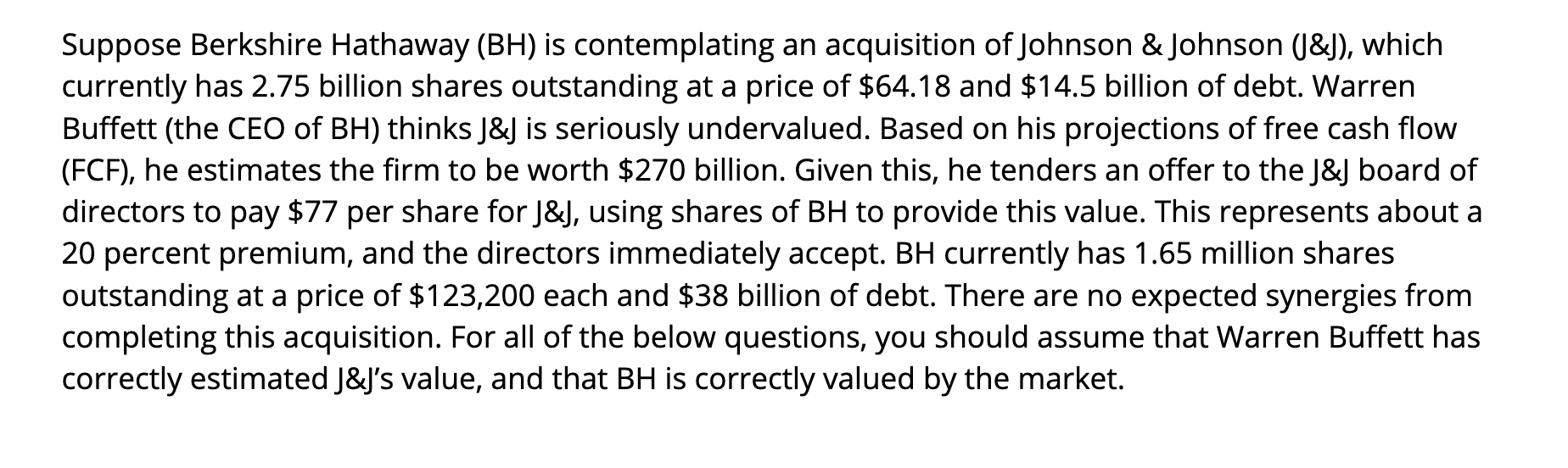

Suppose Berkshire Hathaway (BH) is contemplating an acquisition of Johnson & Johnson (J&)), which currently has 2.75 billion shares outstanding at a price of $64.18

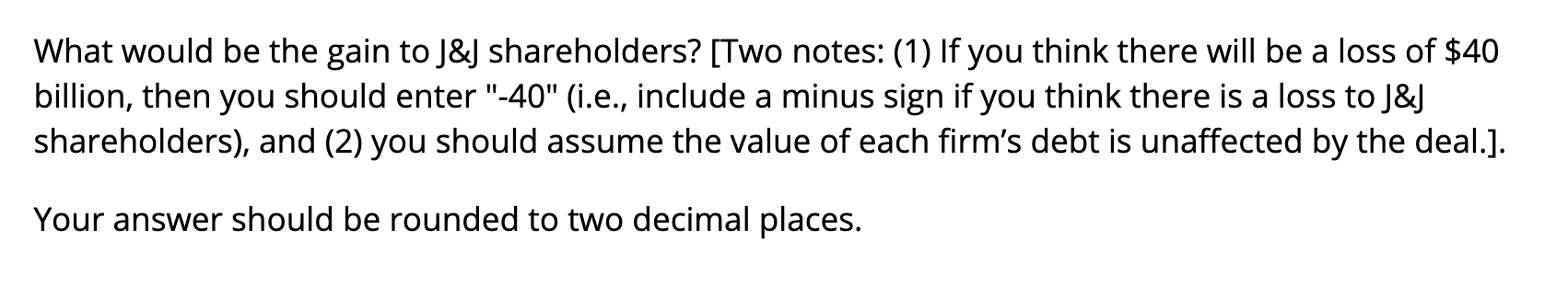

Suppose Berkshire Hathaway (BH) is contemplating an acquisition of Johnson \& Johnson (J\&)), which currently has 2.75 billion shares outstanding at a price of $64.18 and $14.5 billion of debt. Warren Buffett (the CEO of BH ) thinks J\&J is seriously undervalued. Based on his projections of free cash flow (FCF), he estimates the firm to be worth $270 billion. Given this, he tenders an offer to the J\&J board of directors to pay $77 per share for J\&J, using shares of BH to provide this value. This represents about a 20 percent premium, and the directors immediately accept. BH currently has 1.65 million shares outstanding at a price of $123,200 each and $38 billion of debt. There are no expected synergies from completing this acquisition. For all of the below questions, you should assume that Warren Buffett has correctly estimated J\&J's value, and that BH is correctly valued by the market. What would be the gain to J\&] shareholders? [Two notes: (1) If you think there will be a loss of $40 billion, then you should enter "-40" (i.e., include a minus sign if you think there is a loss to J\&J shareholders), and (2) you should assume the value of each firm's debt is unaffected by the deal.]. Your answer should be rounded to two decimal places

Suppose Berkshire Hathaway (BH) is contemplating an acquisition of Johnson \& Johnson (J\&)), which currently has 2.75 billion shares outstanding at a price of $64.18 and $14.5 billion of debt. Warren Buffett (the CEO of BH ) thinks J\&J is seriously undervalued. Based on his projections of free cash flow (FCF), he estimates the firm to be worth $270 billion. Given this, he tenders an offer to the J\&J board of directors to pay $77 per share for J\&J, using shares of BH to provide this value. This represents about a 20 percent premium, and the directors immediately accept. BH currently has 1.65 million shares outstanding at a price of $123,200 each and $38 billion of debt. There are no expected synergies from completing this acquisition. For all of the below questions, you should assume that Warren Buffett has correctly estimated J\&J's value, and that BH is correctly valued by the market. What would be the gain to J\&] shareholders? [Two notes: (1) If you think there will be a loss of $40 billion, then you should enter "-40" (i.e., include a minus sign if you think there is a loss to J\&J shareholders), and (2) you should assume the value of each firm's debt is unaffected by the deal.]. Your answer should be rounded to two decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started