Question

Suppose Bhd the FCF is expected to grow at 5% per year for the next two years. However, the growth rate after that is expected

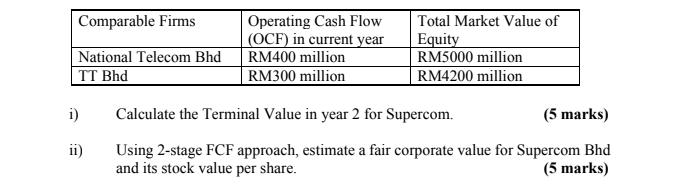

Suppose Bhd the FCF is expected to grow at 5% per year for the next two years. However, the growth rate after that is expected to be very uncertain and the analyst decided to use the terminal value approach in estimating the cash flows beyond second year. Specifically, he decided to estimate the terminal value of the firm by using the Cash Flow Multiple method based on the two comparable firms in the industry stated below: Notes: 1. Operating Cash Flow for Supercom Bhd at the end of year two is expected to be RM750 millions. 2. Total Debt for Supercom Bhd. is constant at RM2400 million

Suppose Bhd the FCF is expected to grow at 5% per year for the next two years. However, the growth rate after that is expected to be very uncertain and the analyst decided to use the terminal value approach in estimating the cash flows beyond second year. Specifically, he decided to estimate the terminal value of the firm by using the Cash Flow Multiple method based on the two comparable firms in the industry stated below: Notes: 1. Operating Cash Flow for Supercom Bhd at the end of year two is expected to be RM750 millions. 2. Total Debt for Supercom Bhd. is constant at RM2400 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started