Answered step by step

Verified Expert Solution

Question

1 Approved Answer

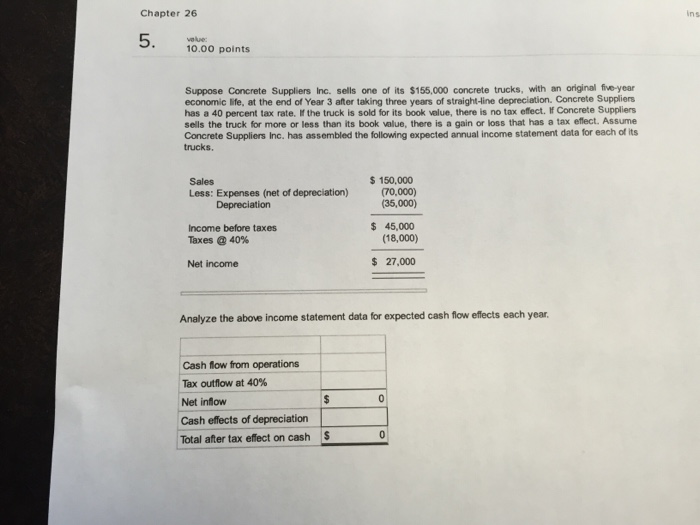

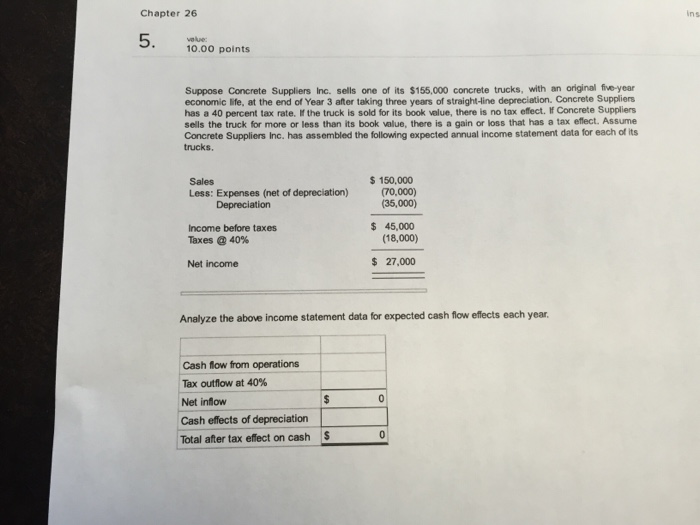

Suppose Concrete Suppliers Inc. sells one of its $155,000 concrete trucks, with an original five-year economic life, at the end of Year 3 after taking

Suppose Concrete Suppliers Inc. sells one of its $155,000 concrete trucks, with an original five-year economic life, at the end of Year 3 after taking three years of straight-line depreciation. Concrete Suppliers has a 40 percent tax rate. If the truck is sold for its book value, there is no tax effect. If Concrete Suppliers sells the truck for more or less than its book value, there is a gain or loss that has a tax effect. Assume Concrete Suppliers Inc. has assembled the following expected annual income statement data for each of its trucks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started