Question

Suppose Crow Sporting Goods Company reported the following data at July 31, 2018 , with amounts in thousands: Use these data to prepare Crow Sporting

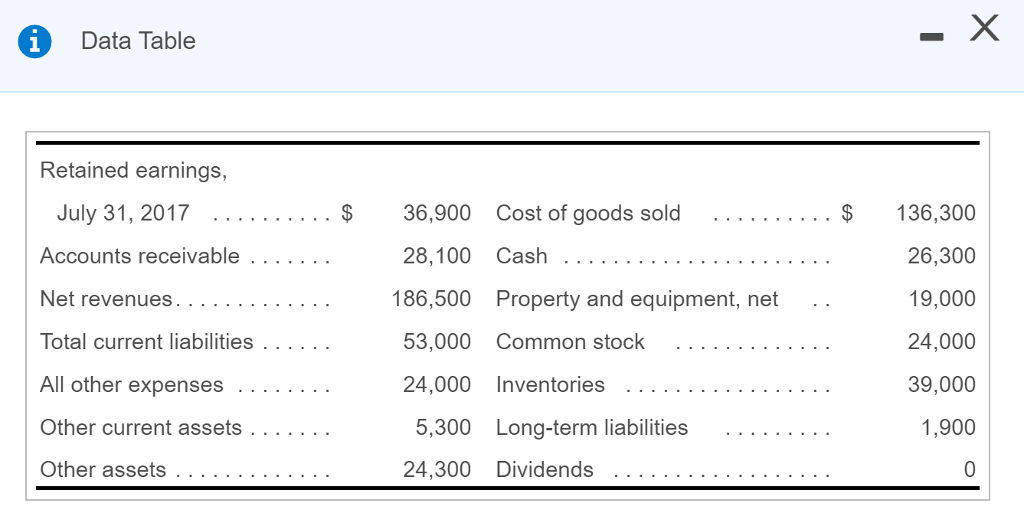

Suppose Crow Sporting Goods Company reported the following data at July 31, 2018 , with amounts in thousands:

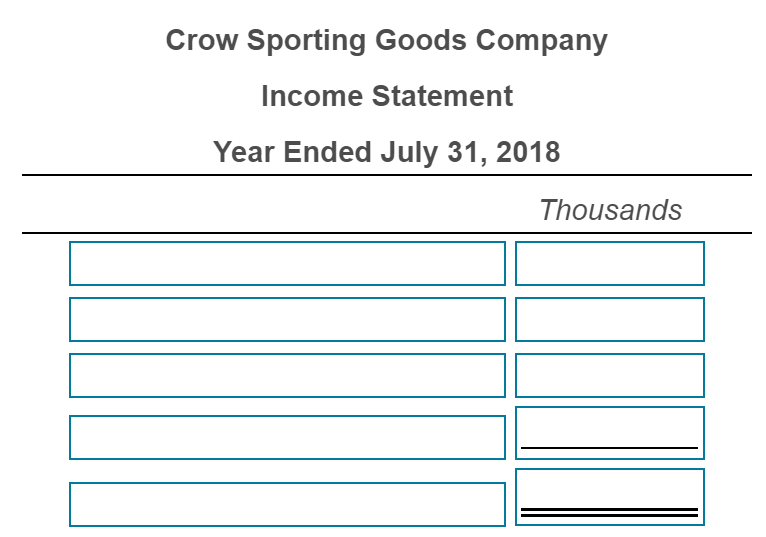

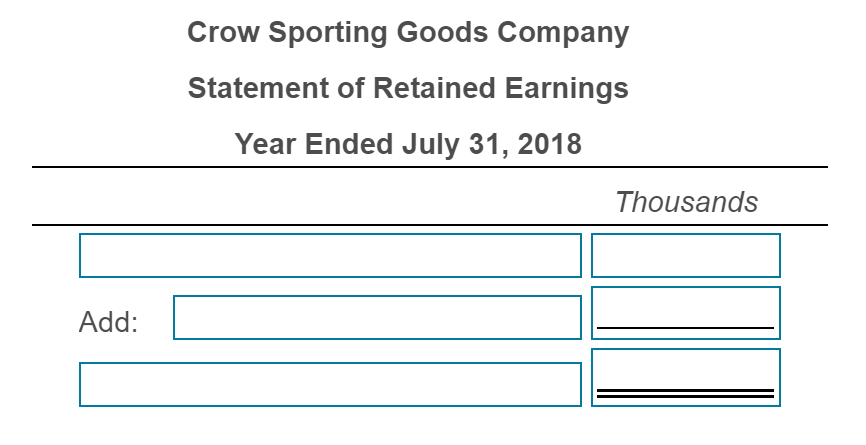

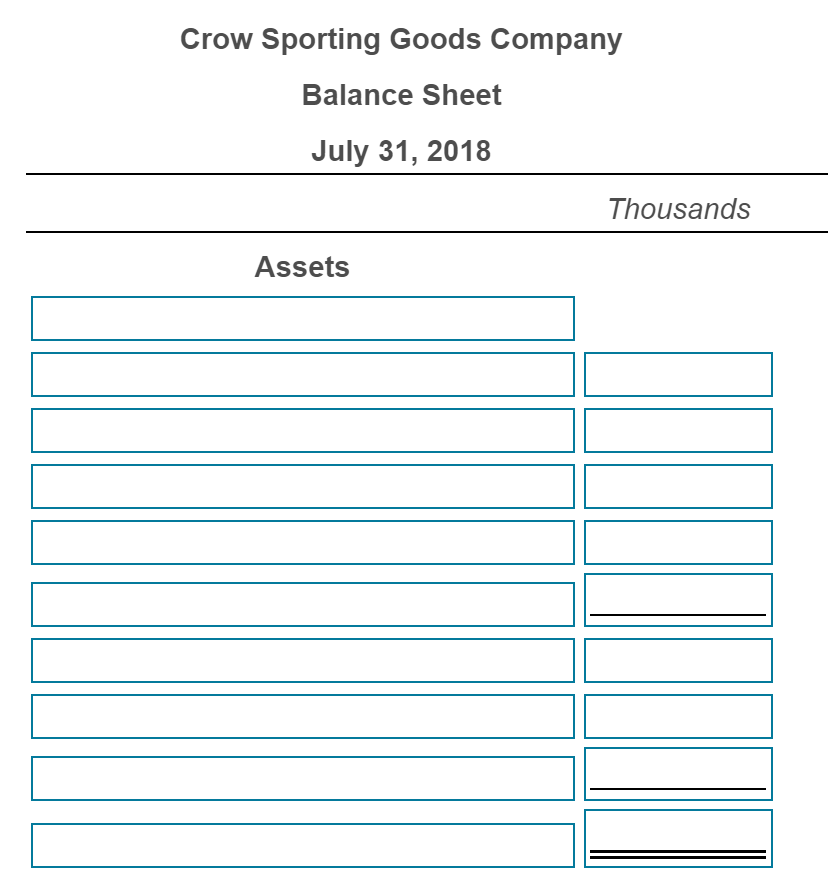

Use these data to prepare Crow Sporting Goods Company's single-step income statement for the year ended July 31, 2018 ; statement of retained earnings for the year ended July 31, 2018 ; and classified balance sheet at July 31, 2018. Use the report format for the balance sheet.

Use the given data to prepare Crow Sporting Goods Company's income statement for the year ended July 31, 2018. (If a box is not used in the income statement leave the box empty; do not select a label or enter a zero.)

Use the given data to prepare Crow Sporting Goods Company's statement of retained earnings for the year ended July 31, 2018.

Use the given data to prepare Crow Sporting Goods Company's classified balance sheet at July 31, 2018. Use the report format for the balance sheet. Complete the assets portion of the balance sheet in this step. The liabilities and shareholders' equity sections will be completed in the next step. (If a box is not used in the balance sheet leave the box empty; do not select a label or enter a zero.)

Data Table Retained earnings, July 31, 2017 $ 36,900 Cost of goods sold $136,300 26,300 19,000 24,000 39,000 1,900 Accounts receivable .. _ . .. . 28,100 Cash 186,500 Property and equipment, net .. lotal current liabilities. . . 53,000 Common stock 24,000 Inventories Other current assets . . . . 5,300 Long-term liabilities 24,300 Dividends Crow Sporting Goods Company Income Statement Year Ended July 31, 2018 Thousands Crow Sporting Goods Company Statement of Retained Earnings Year Ended July 31, 2018 Thousands Add Crow Sporting Goods Company Balance Sheet July 31, 2018 Thousands Assets Liabilities Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started