Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose demand for domestic airline tickets is given by P = 800 - 3Q and supply is given by P = 10 + 2Q.

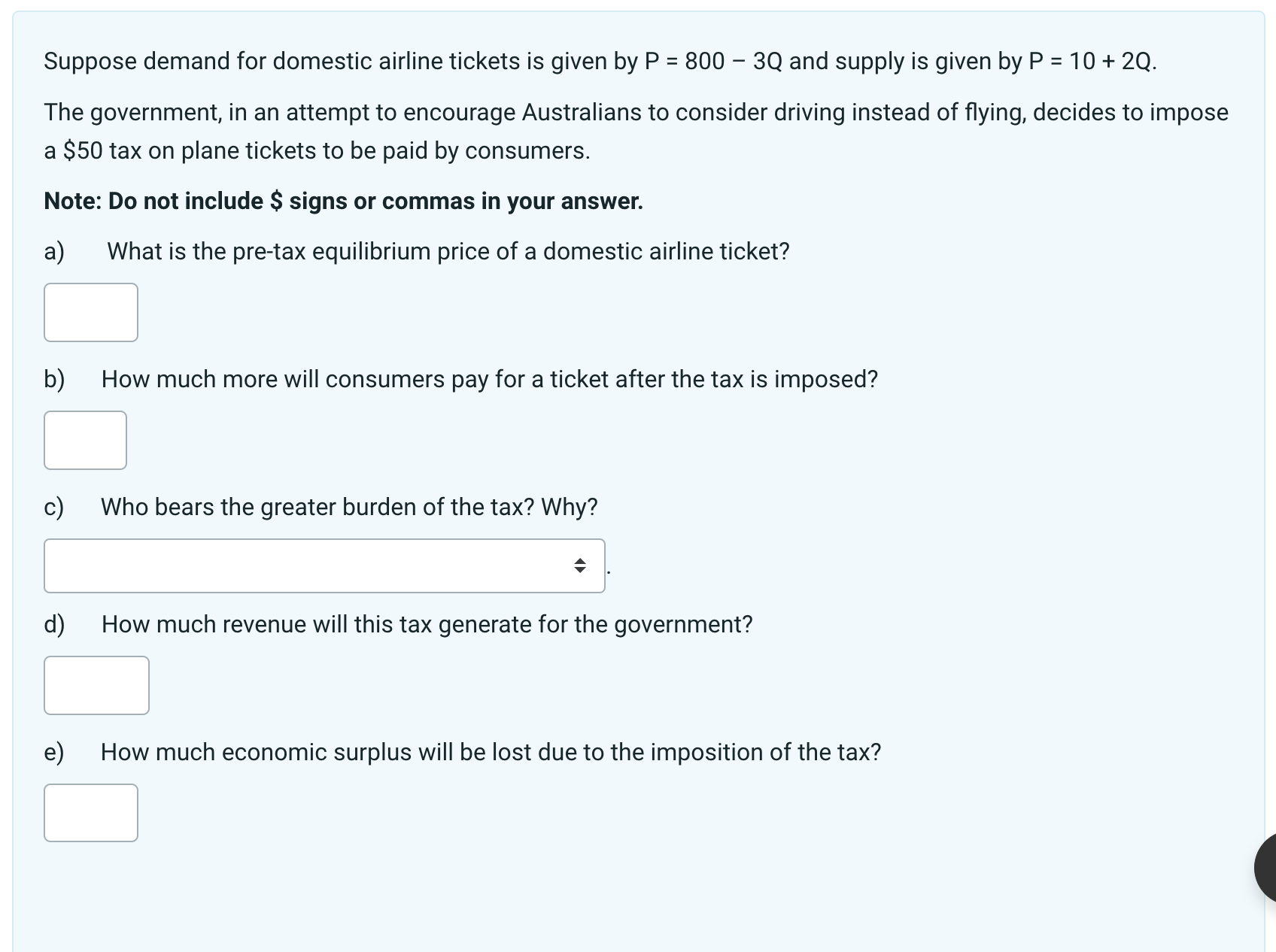

Suppose demand for domestic airline tickets is given by P = 800 - 3Q and supply is given by P = 10 + 2Q. The government, in an attempt to encourage Australians to consider driving instead of flying, decides to impose a $50 tax on plane tickets to be paid by consumers. Note: Do not include $ signs or commas in your answer. a) What is the pre-tax equilibrium price of a domestic airline ticket? b) How much more will consumers pay for a ticket after the tax is imposed? c) Who bears the greater burden of the tax? Why? d) How much revenue will this tax generate for the government? e) How much economic surplus will be lost due to the imposition of the tax?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To find the pretax equilibrium price of a domestic airline ticket we need to set the demand equal to the supply and solve for the price Deman...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e76e6e7299_955556.pdf

180 KBs PDF File

663e76e6e7299_955556.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started