Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose domestic residents of France purchase 1.2 trillion euros of foreign assets. At the same time, assume that foreigners purchase 1.5 trillion euros of

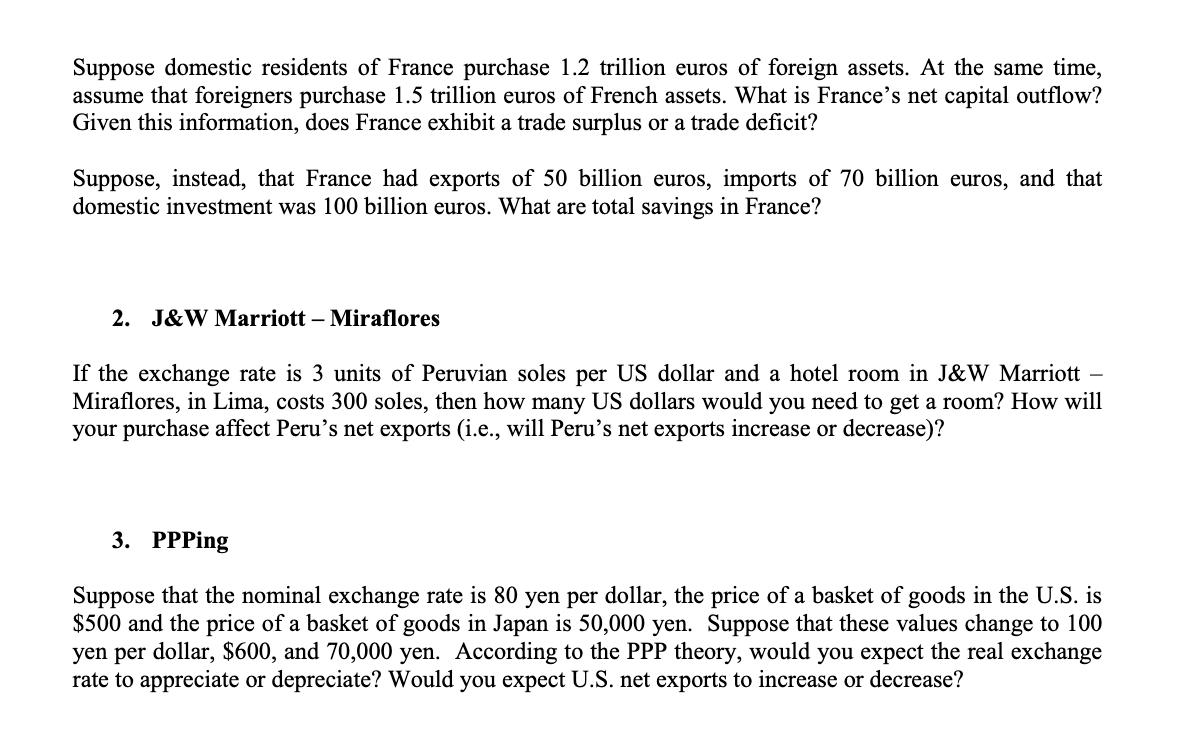

Suppose domestic residents of France purchase 1.2 trillion euros of foreign assets. At the same time, assume that foreigners purchase 1.5 trillion euros of French assets. What is France's net capital outflow? Given this information, does France exhibit a trade surplus or a trade deficit? Suppose, instead, that France had exports of 50 billion euros, imports of 70 billion euros, and that domestic investment was 100 billion euros. What are total savings in France? 2. J&W Marriott - Miraflores If the exchange rate is 3 units of Peruvian soles per US dollar and a hotel room in J&W Marriott - Miraflores, in Lima, costs 300 soles, then how many US dollars would you need to get a room? How will your purchase affect Peru's net exports (i.e., will Peru's net exports increase or decrease)? 3. PPPing Suppose that the nominal exchange rate is 80 yen per dollar, the price of a basket of goods in the U.S. is $500 and the price of a basket of goods in Japan is 50,000 yen. Suppose that these values change to 100 yen per dollar, $600, and 70,000 yen. According to the PPP theory, would you expect the real exchange rate to appreciate or depreciate? Would you expect U.S. net exports to increase or decrease?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 To calculate Frances net capital outflow we need to subtract the amount of foreign assets p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d4b4441e34_968379.pdf

180 KBs PDF File

663d4b4441e34_968379.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started