Question

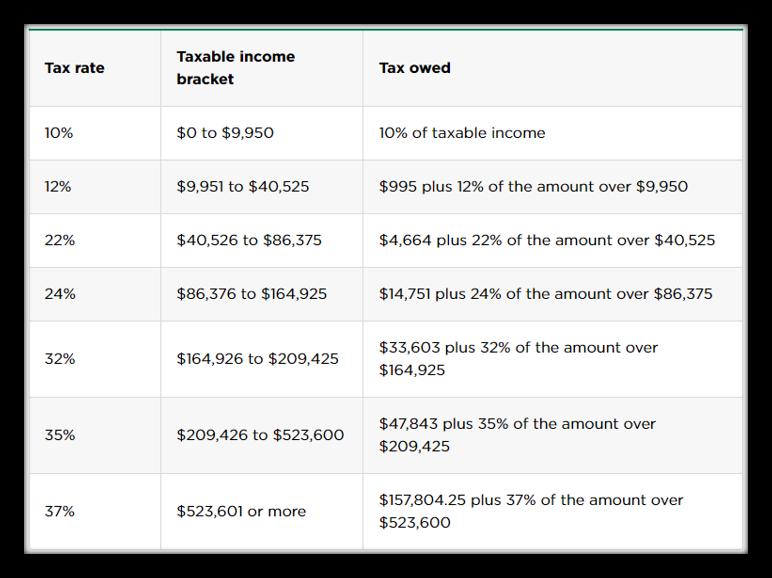

Suppose Elaine has a taxable income of $175,000 and is subject to the following tax schedule as she is married filing jointly. 1) What is

Suppose Elaine has a taxable income of $175,000 and is subject to the following tax schedule as she is married filing jointly.

1) What is Elaine's marginal income tax rate (Hint: tax rate on next dollar earned)?

2) What is Elaine's effective income tax rate (An individual's effective tax rate represents the average of all tax brackets that their income passes through)?

3) What is Elaine's after-tax earnings?

4) Suppose Elaine incurred $5,000 in interest income from municipal bonds, received $8,000 in child support, paid $5,500 in charitable contributions, $7,500 in home mortgage interest, $8,500 in state income taxes, and $2,000 in property taxes. Should Elaine use itemized deductions or the standard deduction of $25,900?

5) Suppose Elaine incurred $5,000 in interest income from municipal bonds, received $8,000 in child support, paid $5,500 in charitable contributions, $7,500 in home mortgage interest, $8,500 in state income taxes, and $2,000 in property taxes. How much in itemized deductions may Elaine take?

Taxable income Tax rate owed bracket 10% $0 to $9,950 10% of taxable income 12% $9,951 to $40,525 $995 plus 12% of the amount over $9,950 22% $40,526 to $86,375 $4,664 plus 22% of the amount over $40,525 24% $86,376 to $164,925 $14,751 plus 24% of the amount over $86,375 $33,603 plus 32% of the amount over 32% $164,926 to $209,425 $164,925 $47,843 plus 35% of the amount over 35% $209,426 to $523,600 $209,425 $157,804.25 plus 37% of the amount over 37% $523,601 or more $523,600

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Solution ANSWER Particulars Amount Average Gross Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started