Answered step by step

Verified Expert Solution

Question

1 Approved Answer

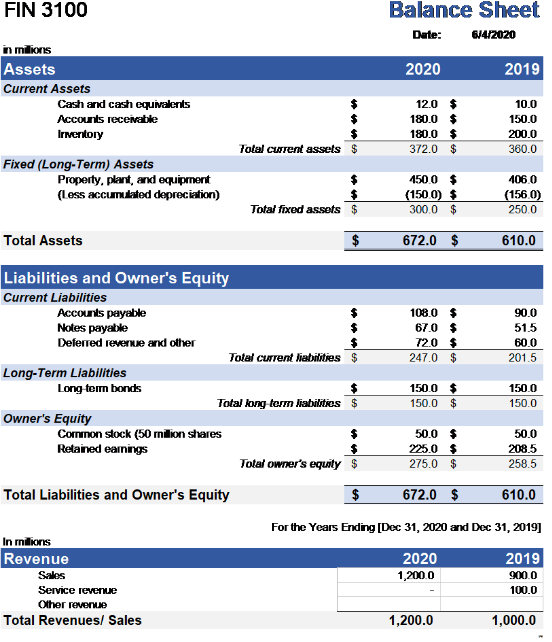

Suppose FIN3100 has current stock price of $2, what is the market/ book ratio? Group of answer choices 2000000 20000 2000 20 2 What is

Suppose FIN3100 has current stock price of $2, what is the market/ book ratio?

Group of answer choices

2000000

20000

2000

20

2

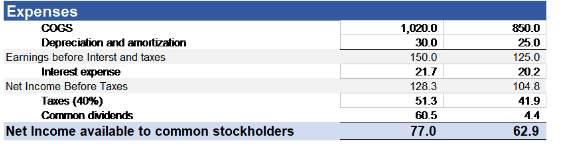

What is the net operating profit after taxes (after-tax operating income) for 2020? (Tax rate = 40%)

(in millions)

Group of answer choices

90

85

56

128.3

77

What are the amounts of net operating working capital for 2020 and 2019?

(in millions)

Group of answer choices

327 & 126

321 &192

192 & 210

237 &327

210 & 321

FIN 3100 Balance Sheet Date: 6/4/2020 2020 2019 in millions Assets Current Assets Cash and cash equivalents Accounts receivable Irmventory Fixed (Long-Term) Assets Property, plant, and equipment (less accumulated depreciation) 12.0 $ 180.0 $ 180.0 $ 372.0 $ 10.0 150.0 200.0 360.0 Total current assets $ 4500 $ (1500) $ 300.0 $ 4060 (1560) 250.0 Total fixed assets $ Total Assets $ 672.0 $ 610.0 108.0 $ 670 $ 720 $ 247.0 $ 90.0 51.5 60.0 201.5 Liabilities and Owner's Equity Current Liabilities Accounts payable Notes payable Deferred revenue and other Total current liabilities $ Long-Term Liabilities Long term bonds Total kong term liabilities $ Owner's Equity Common stock (50 milion shares Retained earnings Total owner's equity $ Total Liabilities and Owner's Equity $ 1500 $ 150.0 $ 1500 150.0 $ 500 $ 225.0 $ 275.0 $ 50.0 208.5 258.5 672.0 $ 610.0 For the Years Ending [Dec 31, 2020 and Dec 31, 2019) In milions Revenue Sales Service revenue Other revenue Total Revenues/ Sales 2020 1,200.0 2019 900.0 100.0 1,200.0 1,000.0 Expenses COGS Depreciation and amortization Earnings before Interst and taxes Interest expense Net Income Before Taxes Taxes (40%) Common dividends Net Income available to common stockholders 1,020.0 300 150.0 21.7 128.3 51.3 60.5 77.0 850.0 250 125.0 20.2 104.8 41.9 4.4 62.9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started