Answered step by step

Verified Expert Solution

Question

1 Approved Answer

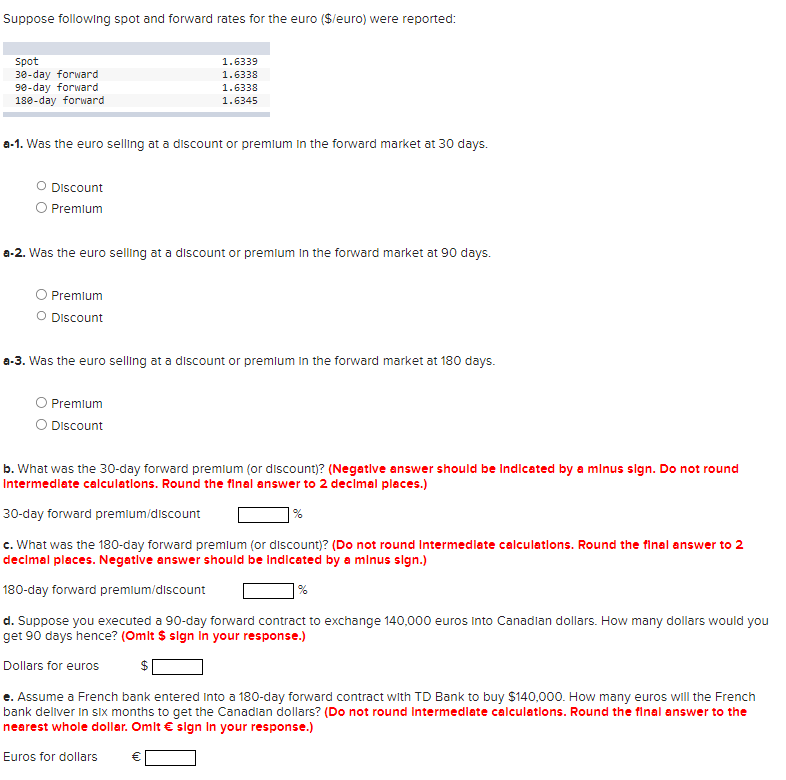

Suppose following spot and forward rates for the euro ($/euro) were reported: Spot 30-day forward 90-day forward 1.6339 1.6338 1.6338 1.6345 180-day forward a-1.

Suppose following spot and forward rates for the euro ($/euro) were reported: Spot 30-day forward 90-day forward 1.6339 1.6338 1.6338 1.6345 180-day forward a-1. Was the euro selling at a discount or premium in the forward market at 30 days. O Discount O Premium a-2. Was the euro selling at a discount or premium in the forward market at 90 days. Premium Discount a-3. Was the euro selling at a discount or premium in the forward market at 180 days. Premium Discount b. What was the 30-day forward premium (or discount)? (Negative answer should be indicated by a minus sign. Do not round Intermediate calculations. Round the final answer to 2 decimal places.) 30-day forward premium/discount % c. What was the 180-day forward premium (or discount)? (Do not round Intermediate calculations. Round the final answer to 2 decimal places. Negative answer should be indicated by a minus sign.) 180-day forward premium/discount % d. Suppose you executed a 90-day forward contract to exchange 140,000 euros Into Canadian dollars. How many dollars would you get 90 days hence? (Omit $ sign in your response.) Dollars for euros $ e. Assume a French bank entered into a 180-day forward contract with TD Bank to buy $140,000. How many euros will the French bank deliver in six months to get the Canadian dollars? (Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Omit sign in your response.) Euros for dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started