Answered step by step

Verified Expert Solution

Question

1 Approved Answer

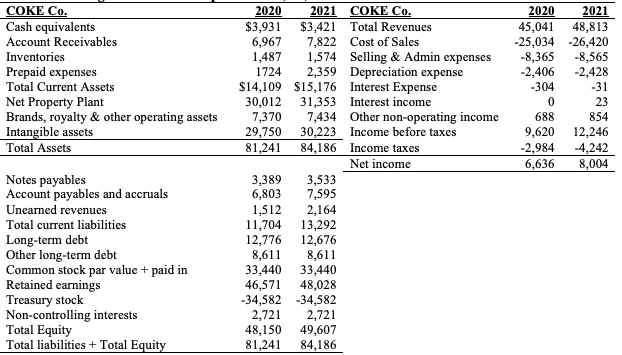

Suppose in 2022, Cokes Total Revenues is expected to grow at 8%, using the Additional Fund Needed (AFN) formula calculate Coke AFN to support its

Suppose in 2022, Cokes Total Revenues is expected to grow at 8%, using the Additional Fund Needed (AFN) formula calculate Coke AFN to support its 8% growth using its status quo in 2021. Then, given your calculated AFN, suppose that Coke decides to fund all its projected AFN by issuing new Long-Term Debt- calculate the projected Total Liabilities-to-Total Asset ratio for Coke in 2022, and explain the change in its future expected financial leverage.

COKE Co. Cash equivalents Account Receivables Inventories Prepaid expenses Total Current Assets Net Property Plant Brands, royalty & other operating assets Intangible assets Total Assets 2020 2021 45,041 48,813 -25,034 -26,420 -8,365 -8,565 -2,406 -2,428 -304 -31 0 23 688 854 9,620 12,246 -2,984 -4,242 6,636 8,004 Notes payables Account payables and accruals Unearned revenues Total current liabilities Long-term debt Other long-term debt Common stock par value + paid in Retained earnings Treasury stock Non-controlling interests Total Equity Total liabilities + Total Equity 2020 2021 COKE Co. $3,931 $3,421 Total Revenues 6,967 7,822 Cost of Sales 1,487 1,574 Selling & Admin expenses 1724 2,359 Depreciation expense $14,109 $15,176 Interest Expense 30,012 31,353 Interest income 7,370 7,434 Other non-operating income 29,750 30,223 Income before taxes 81,241 84,186 Income taxes Net income 3,389 3,533 6,803 7,595 1,512 2,164 11,704 13,292 12,776 12,676 8,611 8,611 33,440 33,440 46,571 48,028 -34,582 -34,582 2,721 2,721 48,150 49,607 81,241 84,186Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started