Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose in previous year ACB paid a dividend of VND20000. The dividend growth rate is expected of 8%/year for next 4 years, then the

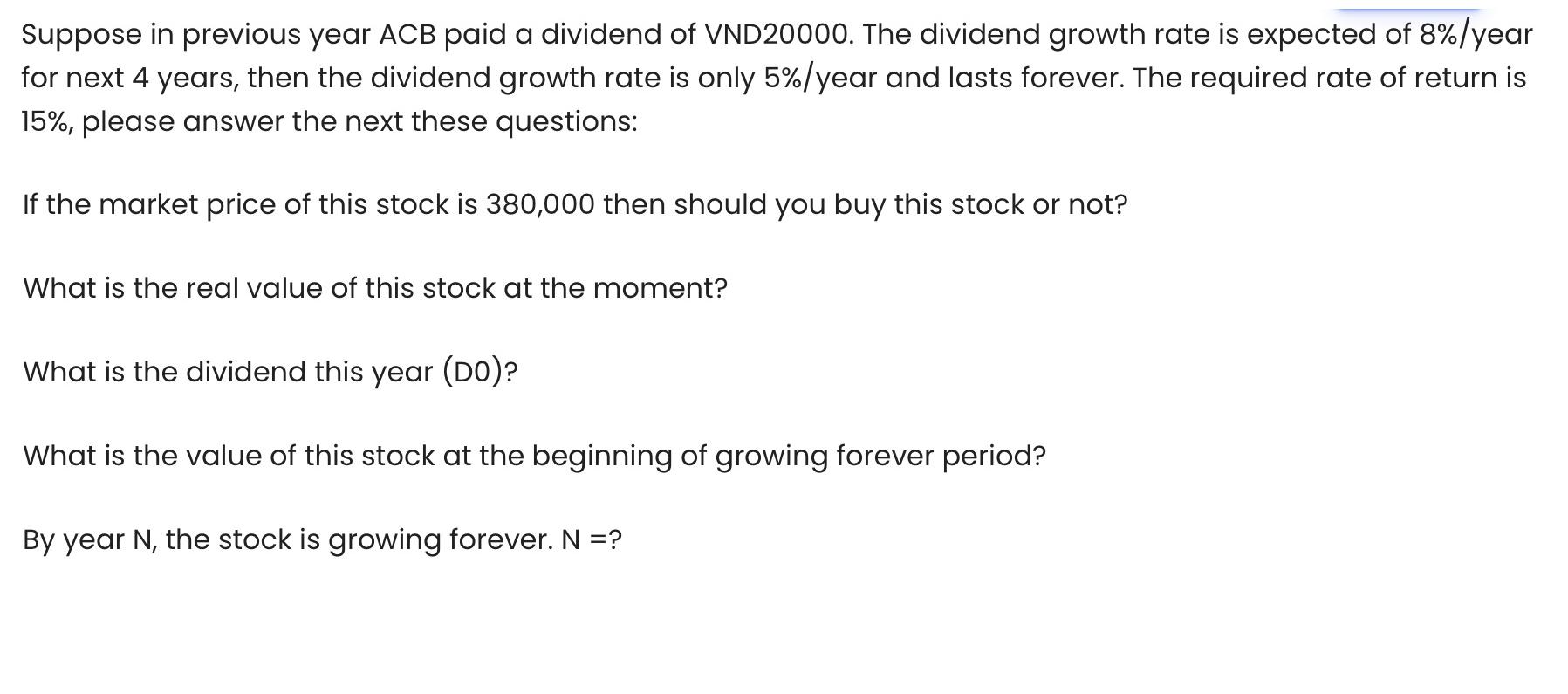

Suppose in previous year ACB paid a dividend of VND20000. The dividend growth rate is expected of 8%/year for next 4 years, then the dividend growth rate is only 5%/year and lasts forever. The required rate of return is 15%, please answer the next these questions: If the market price of this stock is 380,000 then should you buy this stock or not? What is the real value of this stock at the moment? What is the dividend this year (DO)? What is the value of this stock at the beginning of growing forever period? By year N, the stock is growing forever. N =?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions we need to calculate the present value of the dividends and the perpetuity value at different time periods To determine whethe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started