Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose investors can invest in two risky assets deriving returns R, R2 and in a riskless asset deriving a return Rf. Consider a portfolio

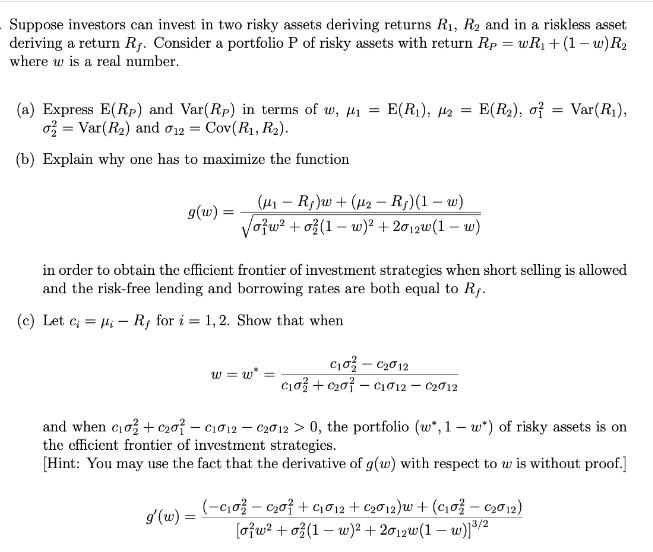

Suppose investors can invest in two risky assets deriving returns R, R2 and in a riskless asset deriving a return Rf. Consider a portfolio P of risky assets with return Rp=wR+(1-w) R where w is a real number. (a) Express E(Rp) and Var(Rp) in terms of w, = E(R), 2= E(R), of = Var (R), 02= Var (R) and 12 = Cov(R, R). (b) Explain why one has to maximize the function g(w): = (-R)w+(-R)(1-w) ow +0(1-w) +202w(1 w) - in order to obtain the efficient frontier of investment strategies when short selling is allowed and the risk-free lending and borrowing rates are both equal to Rf. (c) Let c = R, for i=1,2. Show that when g'(w) = w=w* = C102-C012 c0+007-C1012 - 02012 and when c0+ c07-C1012-C2012 > 0, the portfolio (w*, 1-w*) of risky assets is on the efficient frontier of investment strategies. [Hint: You may use the fact that the derivative of g(w) with respect to w is without proof.] (-0-0+9012 + C012)w + (c02 - C012) [ow +0(1-w) + 2012w(1-w)1/2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Expressions for ERp and VarRp in terms of w ER1 ER2 VarR1 VarR2 and CovR1 R2 Expected return of portfolio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started