Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose it's January 2021 and you would like to estimate the unlevered cost of capital (r) for Cowbell Corp. The current share price of

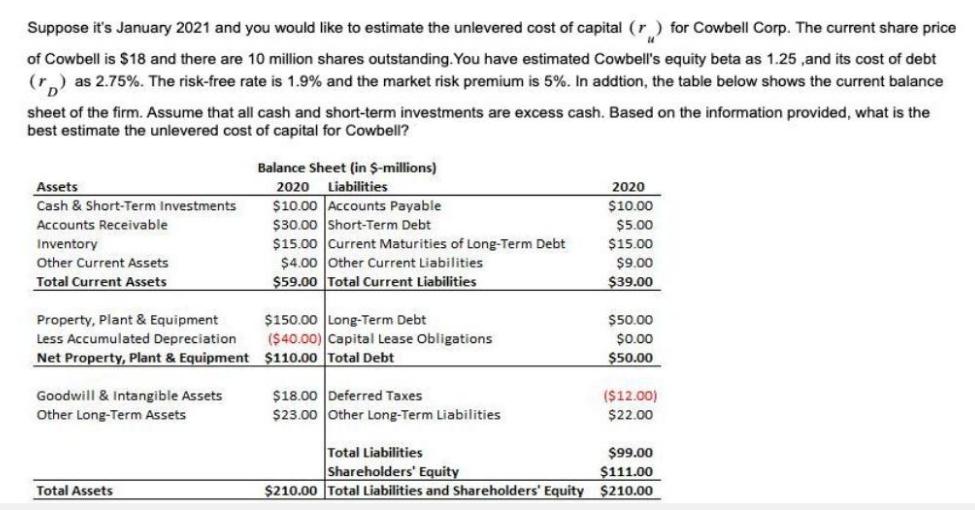

Suppose it's January 2021 and you would like to estimate the unlevered cost of capital (r) for Cowbell Corp. The current share price of Cowbell is $18 and there are 10 million shares outstanding. You have estimated Cowbell's equity beta as 1.25 ,and its cost of debt (r) as 2.75%. The risk-free rate is 1.9% and the market risk premium is 5%. In addtion, the table below shows the current balance sheet of the firm. Assume that all cash and short-term investments are excess cash. Based on the information provided, what is the best estimate the unlevered cost of capital for Cowbell? Assets Cash & Short-Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Property, Plant & Equipment Less Accumulated Depreciation Net Property, Plant & Equipment Goodwill & Intangible Assets Other Long-Term Assets Total Assets Balance Sheet (in $-millions) 2020 Liabilities $10.00 Accounts Payable $30.00 Short-Term Debt $15.00 Current Maturities of Long-Term Debt $4.00 Other Current Liabilities $59.00 Total Current Liabilities $150.00 Long-Term Debt ($40.00) Capital Lease Obligations $110.00 Total Debt $18.00 Deferred Taxes $23.00 Other Long-Term Liabilities 2020 $10.00 $5.00 $15.00 $9.00 $39.00 $50.00 $0.00 $50.00 ($12.00) $22.00 Total Liabilities $99.00 Shareholders' Equity $111.00 $210.00 Total Liabilities and Shareholders' Equity $210.00

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the unlevered cost of capital r for Cowbell Corp you can use the following steps 1 Calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started