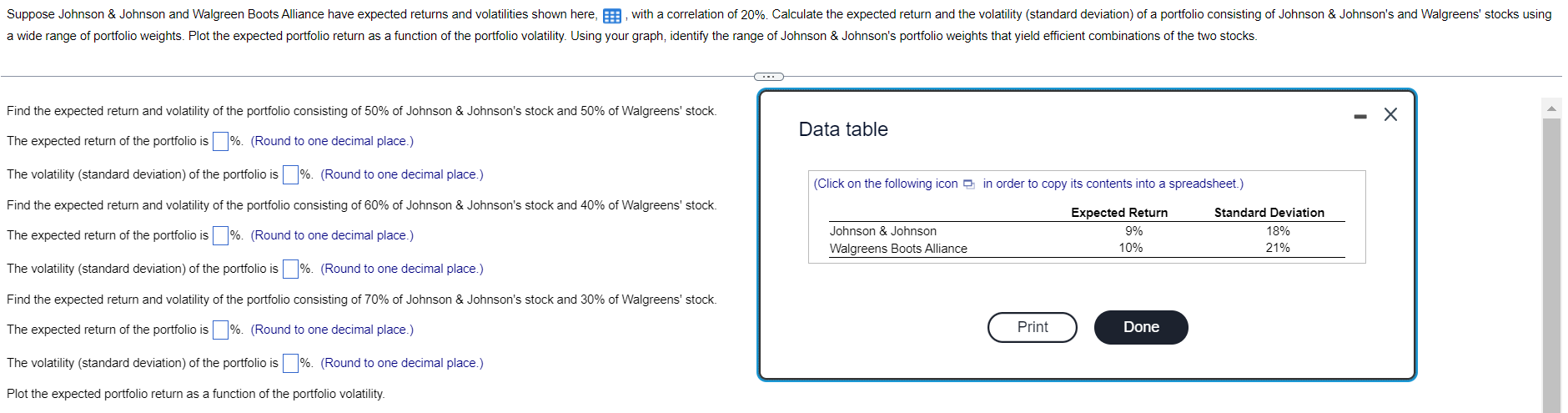

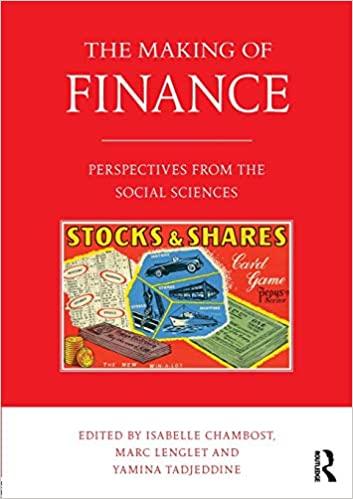

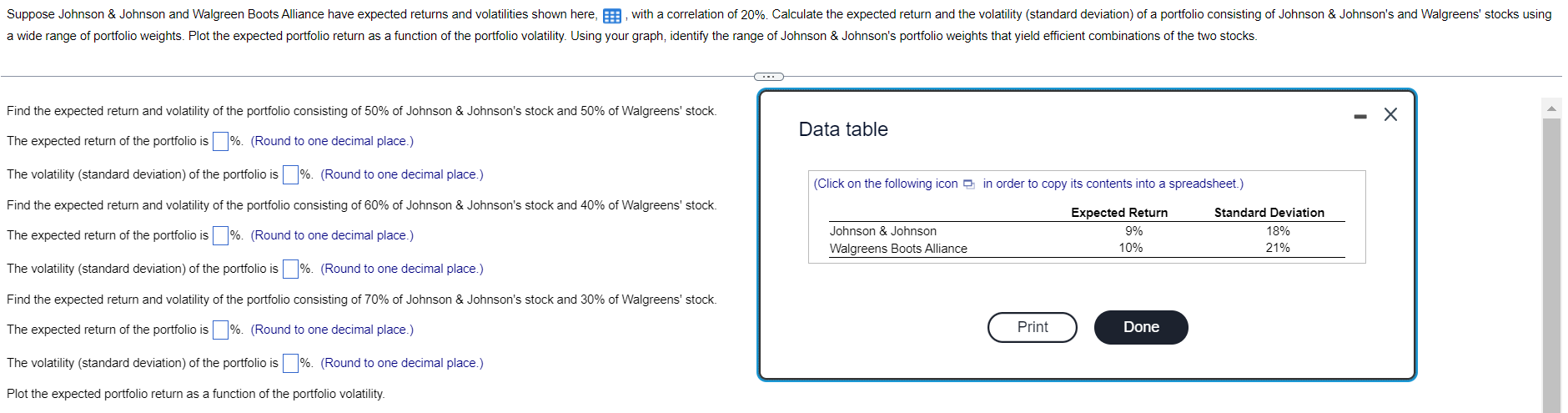

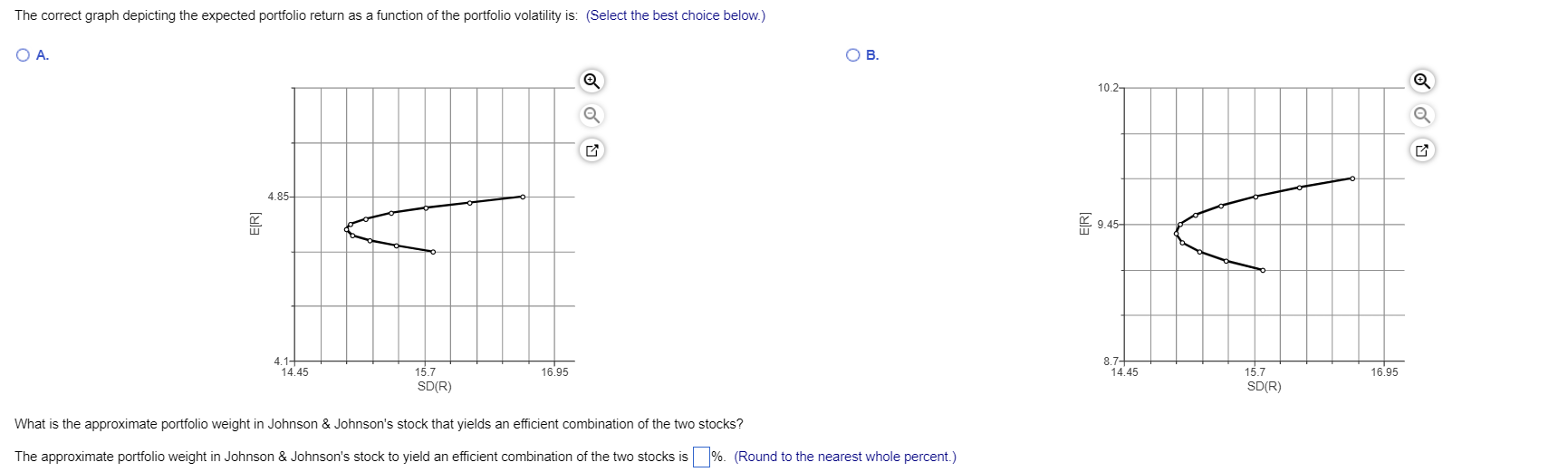

Suppose Johnson & Johnson and Walgreen Boots Alliance have expected returns and volatilities shown here,, with a correlation of 20%. Calculate the expected return and the volatility (standard deviation) of a portfolio consisting of Johnson & Johnson's and Walgreens' stocks using a wide range of portfolio weights. Plot the expected portfolio return as a function of the portfolio volatility. Using your graph, identify the range of Johnson & Johnson's portfolio weights that yield efficient combinations of the two stocks. Find the expected return and volatility of the portfolio consisting of 50% of Johnson & Johnson's stock and 50% of Walgreens' stock. The expected return of the portfolio is %. (Round to one decimal place.) The volatility (standard deviation) of the portfolio is%. (Round to one decimal place.) Find the expected return and volatility of the portfolio consisting of 60% of Johnson & Johnson's stock and 40% of Walgreens' stock. The expected return of the portfolio is%. (Round to one decimal place.) The volatility (standard deviation) of the portfolio is%. (Round to one decimal place.) Find the expected return and volatility of the portfolio consisting of 70% of Johnson & Johnson's stock and 30% of Walgreens' stock. The expected return of the portfolio is%. (Round to one decimal place.) The volatility (standard deviation) of the portfolio is%. (Round to one decimal place.) Plot the expected portfolio return as a function of the portfolio volatility. (...) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Expected Return 9% 10% Johnson & Johnson Walgreens Boots Alliance Print Done Standard Deviation 18% 21% - X The correct graph depicting the expected portfolio return as a function of the portfolio volatility is: (Select the best choice below.) O A. E[R] 4.85- 4.1- 14.45 15.7 SD(R) 16.95 Q O B. What is the approximate portfolio weight in Johnson & Johnson's stock that yields an efficient combination of the two stocks? The approximate portfolio weight in Johnson & Johnson's stock to yield an efficient combination of the two stocks is %. (Round to the nearest whole percent.) E[R] 10.2- 9.45- 8.7+ 14.45 15.7 SD(R) 16.95 Q Suppose Johnson & Johnson and Walgreen Boots Alliance have expected returns and volatilities shown here,, with a correlation of 20%. Calculate the expected return and the volatility (standard deviation) of a portfolio consisting of Johnson & Johnson's and Walgreens' stocks using a wide range of portfolio weights. Plot the expected portfolio return as a function of the portfolio volatility. Using your graph, identify the range of Johnson & Johnson's portfolio weights that yield efficient combinations of the two stocks. Find the expected return and volatility of the portfolio consisting of 50% of Johnson & Johnson's stock and 50% of Walgreens' stock. The expected return of the portfolio is %. (Round to one decimal place.) The volatility (standard deviation) of the portfolio is%. (Round to one decimal place.) Find the expected return and volatility of the portfolio consisting of 60% of Johnson & Johnson's stock and 40% of Walgreens' stock. The expected return of the portfolio is%. (Round to one decimal place.) The volatility (standard deviation) of the portfolio is%. (Round to one decimal place.) Find the expected return and volatility of the portfolio consisting of 70% of Johnson & Johnson's stock and 30% of Walgreens' stock. The expected return of the portfolio is%. (Round to one decimal place.) The volatility (standard deviation) of the portfolio is%. (Round to one decimal place.) Plot the expected portfolio return as a function of the portfolio volatility. (...) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Expected Return 9% 10% Johnson & Johnson Walgreens Boots Alliance Print Done Standard Deviation 18% 21% - X The correct graph depicting the expected portfolio return as a function of the portfolio volatility is: (Select the best choice below.) O A. E[R] 4.85- 4.1- 14.45 15.7 SD(R) 16.95 Q O B. What is the approximate portfolio weight in Johnson & Johnson's stock that yields an efficient combination of the two stocks? The approximate portfolio weight in Johnson & Johnson's stock to yield an efficient combination of the two stocks is %. (Round to the nearest whole percent.) E[R] 10.2- 9.45- 8.7+ 14.45 15.7 SD(R) 16.95