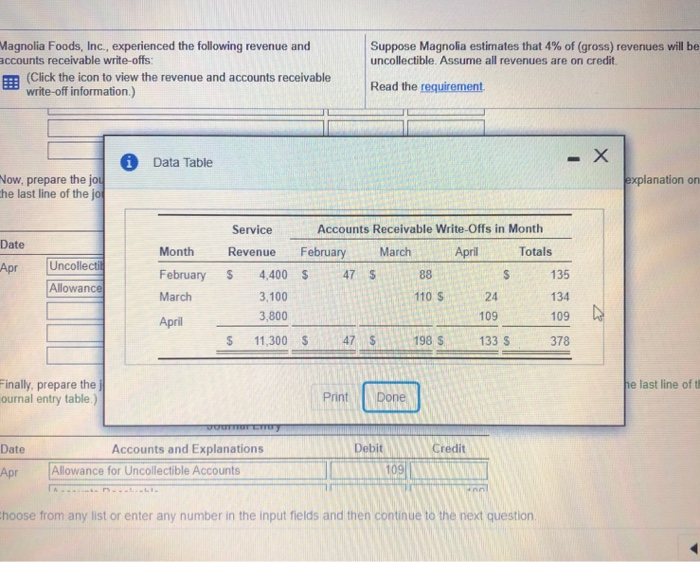

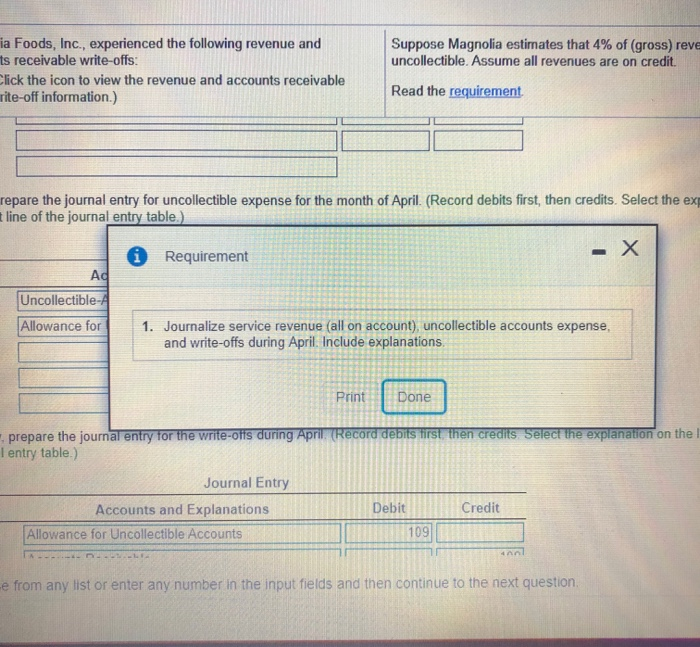

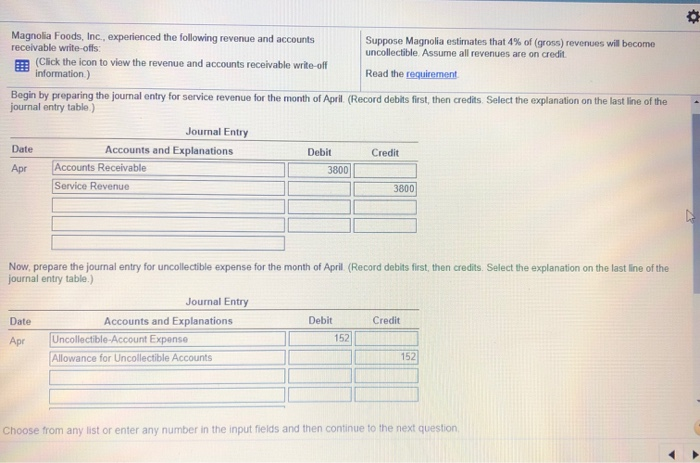

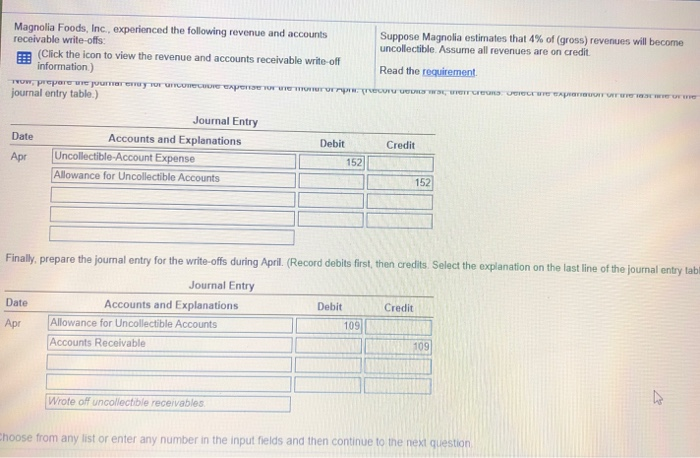

Suppose Magnolia estimates that 4% of (gross) revenues will be uncollectible. Assume all revenues are on credit. Magnolia Foods, Inc., experienced the following revenue and accounts receivable write-offs: (Click the icon to view the revenue and accounts receivable write-off information.) Read the requirement. i Data Table -X Now, prepare the joy the last line of the jo explanation on Date Apr Month Uncollectie Allowance February March Service Accounts Receivable Write-Offs in Month Revenue February March April Totals 4,400 $ 47 $ 88 $ 135 3,100 110 S 24 134 3,800 109 109 $ 11,300 $ 47 $ 198 $ 133 $ 378 April he last line of to Finally, prepare the ournal entry table.) Print Done WOTE CITY Date Credit Accounts and Explanations Allowance for Uncollectible Accounts Debit 109 Ann hoose from any list or enter any number in the input fields and then continue to the next question Suppose Magnolia estimates that 4% of (gross) reve uncollectible. Assume all revenues are on credit. ia Foods, Inc., experienced the following revenue and ts receivable write-offs: Click the icon to view the revenue and accounts receivable rite-off information.) Read the requirement. repare the journal entry for uncollectible expense for the month of April. (Record debits first, then credits. Select the ex t line of the journal entry table.) Requirement - X Ad Uncollectible- Allowance for 1. Journalize service revenue (all on account), uncollectible accounts expense, and write-offs during April. Include explanations, Print Done prepare the journal entry for the write-offs during April (Record debits first then credits Select the explanation on the I entry table.) Journal Entry Accounts and Explanations Allowance for Uncollectible Accounts Credit Debit 109 ---- -e from any list or enter any number in the input fields and then continue to the next question o Magnolia Foods, Inc., experienced the following revenue and accounts Suppose Magnolia estimates that 4% of (gross) revenues will become receivable write-offs: uncollectible Assume all revenues are on credit Click the icon to view the revenue and accounts receivable write-off information) Read the requirement Begin by preparing the journal entry for service revenue for the month of April. (Record debits first, then credits. Select the explanation on the last line of the journal entry table) Journal Entry Accounts and Explanations Debit Credit Apr Accounts Receivable 3800 Service Revenue 3800 Date Now, prepare the journal entry for uncollectible expense for the month of April (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journal Entry Date Accounts and Explanations Debit Credit Apr Uncollectible Account Expense 152 Allowance for Uncollectible Accounts 152 Choose from any list or enter any number in the input fields and then continue to the next question Magnolia Foods, Inc., experienced the following revenue and accounts Suppose Magnolia estimates that 4% of (gross) revenues will become receivable write-offs: uncollectible. Assume all revenues are on credit Click the icon to view the revenue and accounts receivable write-off information) Read the requirement TROW, prepare we Journey To CONCE CAPE VOOR recorrer ODIOCESAPORTOITUTE journal entry table.) Journal Entry Date Accounts and Explanations Debit Credit Apr Uncollectible-Account Expense 152 Allowance for Uncollectible Accounts 152 Finally, prepare the journal entry for the write-offs during April (Record debits first, then credits. Select the explanation on the last line of the journal entry tab Journal Entry Date Accounts and Explanations Debit Credit Apr Allowance for Uncollectible Accounts 109 Accounts Receivable 109 Wrote off uncollectible receivables Choose from any list or enter any number in the input fields and then continue to the next