Question

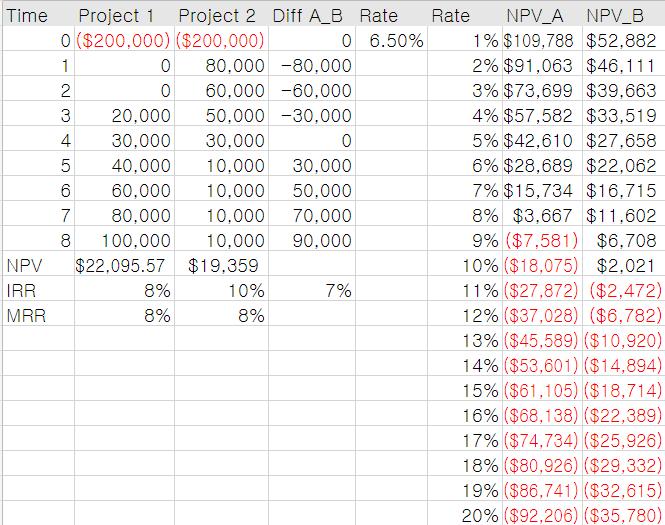

Both these projects have the same economic life of eight years and average risk characteristics. BBCs weighted average cost of capital, or hurdle rate, is

Both these projects have the same economic life of eight years and average risk characteristics. BBC’s weighted average cost of capital, or hurdle rate, is 6.5 percent.

1a. Which project would you recommend be accepted to maximize the value of the firm?

1b. Are the IRRs correct?

1c. What is the approximate discount rate at which both projects would have the same NPV?

1d. What is the payback period (PBP) and discounted payback period (DPBP) of Project 1 and Project 2?

1e. What is the modified internal rate of return (MIRR) of Project 1 and Project 2?

1f. What is the Profitability Index of Project 1 and Project 2?

Time Project 1 Project 2 Diff A_B Rate ($200,000) 0 6.50% NPV IRR MRR 0 ($200,000) 1 2 W N 0 0 LO 3 20,000 4 30,000 30,000 0 5 40,000 10,000 30,000 6 60,000 10,000 50,000 7 80,000 10,000 70,000 8 100,000 10,000 90,000 $22,095.57 $19,359 80,000 -80,000 60,000 -60,000 8% 8% 50,000-30,000 10% 8% 7% Rate NPV A NPV_B 1% $109,788 $52,882 2% $91,063 $46,111 3% $73,699 $39.663 4% $57,582 $33,519 5% $42,610 $27.658 6% $28,689 $22,062 7% $15,734 $16,715 8% $3,667 $11.602 9% ($7,581) $6.708 10% ($18,075) $2.021 11% ($27,872) ($2,472) 12% ($37,028) ($6,782) 13% ($45,589) ($10,920) 14% ($53,601) ($14,894) 15% ($61,105) ($18,714) 16% ($68,138) ($22,389) 17% ($74,734) ($25,926) 18% ($80,926) ($29,332) 19% ($86,741) ($32,615) 20% ($92,206) ($35,780)

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1a As Project 1 has higher NOV accept Project 1 as it maximises the value of firm 1b I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started