Question

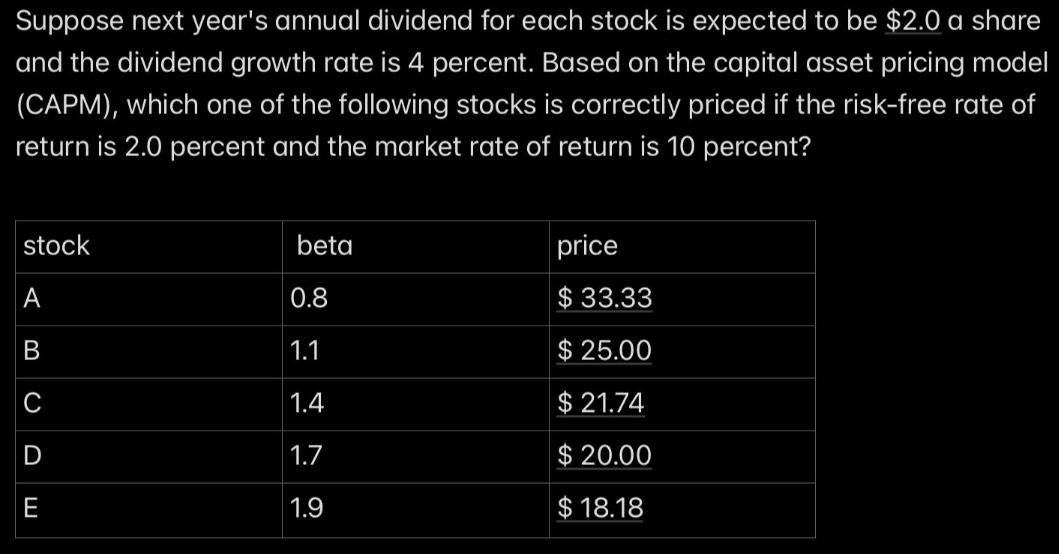

Suppose next year's annual dividend for each stock is expected to be $2.0 a share and the dividend growth rate is 4 percent. Based

Suppose next year's annual dividend for each stock is expected to be $2.0 a share and the dividend growth rate is 4 percent. Based on the capital asset pricing model (CAPM), which one of the following stocks is correctly priced if the risk-free rate of return is 2.0 percent and the market rate of return is 10 percent? stock A beta 0.8 price $33.33 $ 25.00 B 1.1 C 1.4 $ 21.74 D 1.7 $ 20.00 E 1.9 $ 18.18

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Benefit Analysis Concepts and Practice

Authors: Anthony Boardman, David Greenberg, Aidan Vining, David Weimer

4th edition

137002696, 978-1108448284, 1108448283, 978-0137002696

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App