Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose on 03/15/2018, you are expecting that the yield curve will flatten You want to enter into a spread trade using $100 million face

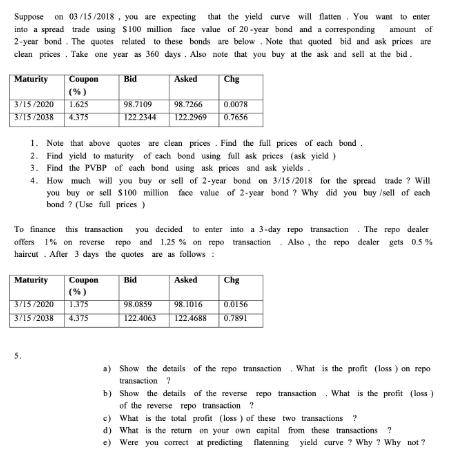

Suppose on 03/15/2018, you are expecting that the yield curve will flatten You want to enter into a spread trade using $100 million face value of 20-year bond and a corresponding amount of 2-year bond. The quotes related to these bonds are below. Note that quoted bid and ask prices are clean prices. Take one year as 360 days. Also note that you buy at the ask and sell at the bid. Maturity Coupon (%) 3/15/2020 1.625 3/15/2038 4.375 Bid 5. Maturity Coupon (%) 3/15/2020 1.375 3/15/2038 4.375 Asked 98.7109 98.7266 0.0078 122.2344 122.2969 0.7656 1. Note that above quotes are clean prices. Find the full prices of each bond. 2. Find yield to maturity of each bond using full ask prices (ask yield) 3. Find the PVBP of each bond using ask prices and ask yields. Chg 4. How much will you buy or sell of 2-year bond on 3/15/2018 for the spread trade? Will you buy or sell $100 million face value of 2-year bond? Why did you buy /sell of each bond ? (Use full prices) To finance this transaction you decided to enter offers 1% on reverse repo and 1.25 % on repo haircut. After 3 days the quotes are as follows: Bid Asked into a 3-day repo transaction. The repo dealer transaction Also, the repo dealer gets 0.5% Chg 98.0859 98.1016 0.0156 122.4063 122.4688 0.7891 What is the profit (loss) on repo b) Show the details of the reverse repo transaction What is the profit (loss) of the reverse repo transaction ? c) What is the total profit (loss) of these two transactions ? d) What is the return on your own capital from these transactions ? e) Were you correct at predicting flatenning yield curve? Why? Why not? a) Show the details of the repo transaction transaction ?

Step by Step Solution

★★★★★

3.55 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the required values well follow the given steps 1 Full Price of Each Bond 2year bond Full Price Asked Price Asked Price Chg Full Price 987266 987266 00078 994052 20year bond Full Price As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started