Answered step by step

Verified Expert Solution

Question

1 Approved Answer

M/s. ABC Associates sent goods worth Rs. 1,00,000 on 11th March on reject or approval basis. Out of these goods worth Rs. 40,000 were

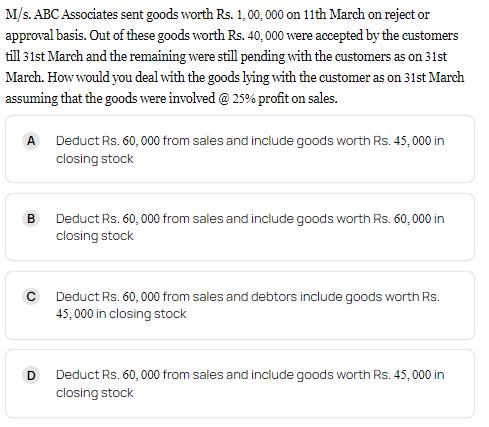

M/s. ABC Associates sent goods worth Rs. 1,00,000 on 11th March on reject or approval basis. Out of these goods worth Rs. 40,000 were accepted by the customers till 31st March and the remaining were still pending with the customers as on 31st March. How would you deal with the goods lying with the customer as on 31st March assuming that the goods were involved @ 25% profit on sales. A Deduct Rs. 60,000 from sales and include goods worth Rs. 45,000 in closing stock B C D Deduct Rs. 60, 000 from sales and include goods worth Rs. 60, 000 in closing stock Deduct Rs. 60, 000 from sales and debtors include goods worth Rs. 45,000 in closing stock Deduct Rs. 60,000 from sales and include goods worth Rs. 45,000 in closing stock

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Correct option is CThe correct answer is C Deduct Rs 60000 from sales and include goods wor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started