Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose on January 15, 2013, the U.S. Treasury issued a five-year inflation-indexed note with a coupon of 5%. On the date of issue, the

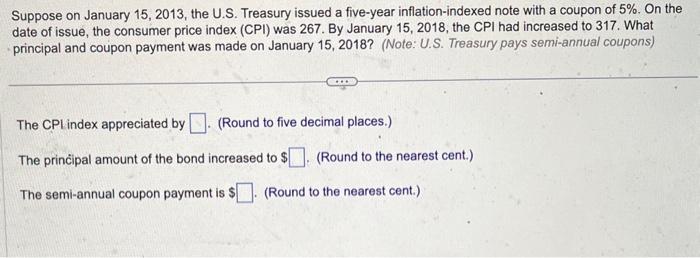

Suppose on January 15, 2013, the U.S. Treasury issued a five-year inflation-indexed note with a coupon of 5%. On the date of issue, the consumer price index (CPI) was 267. By January 15, 2018, the CPI had increased to 317. What principal and coupon payment was made on January 15, 2018? (Note: U.S. Treasury pays semi-annual coupons) The CPL index appreciated by (Round to five decimal places.) The principal amount of the bond increased to $. (Round to the nearest cent.) The semi-annual coupon payment is $ (Round to the nearest cent.).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dda58e1757_961619.pdf

180 KBs PDF File

663dda58e1757_961619.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started