Question

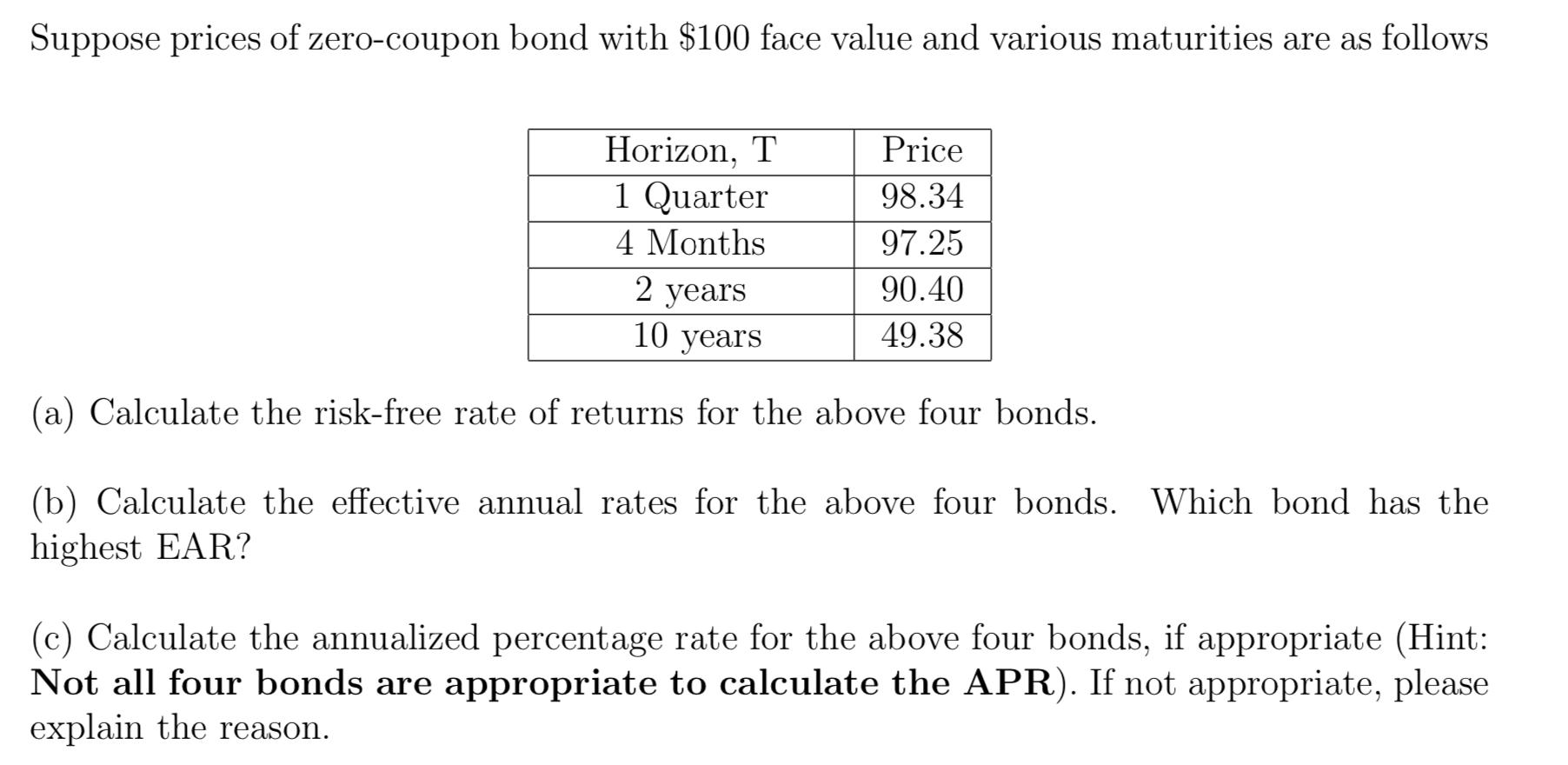

Suppose prices of zero-coupon bond with $100 face value and various maturities are as follows Price Horizon, T 1 Quarter 98.34 4 Months 97.25

Suppose prices of zero-coupon bond with $100 face value and various maturities are as follows Price Horizon, T 1 Quarter 98.34 4 Months 97.25 2 years 10 years 90.40 49.38 (a) Calculate the risk-free rate of returns for the above four bonds. (b) Calculate the effective annual rates for the above four bonds. Which bond has the highest EAR? (c) Calculate the annualized percentage rate for the above four bonds, if appropriate (Hint: Not all four bonds are appropriate to calculate the APR). If not appropriate, please explain the reason.

Step by Step Solution

3.41 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

a Rate of return 100 Price 1 For Bond 1 100 9834 1 001688 or 1688 For Bond 2 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical financial management

Authors: William r. Lasher

5th Edition

0324422636, 978-0324422634

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App