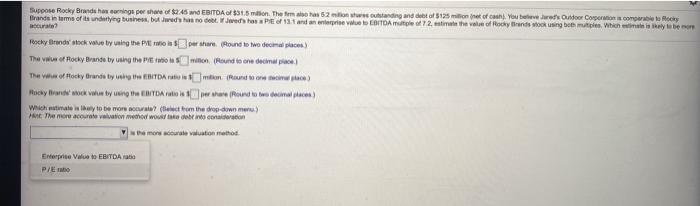

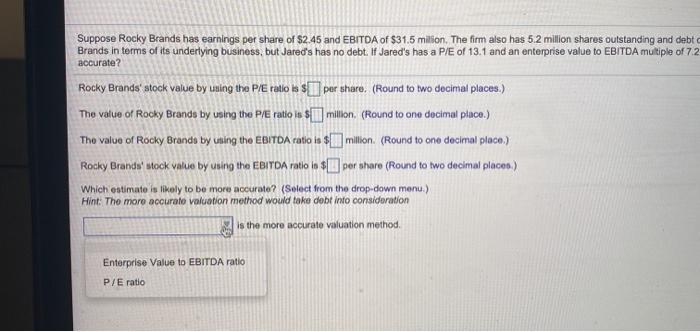

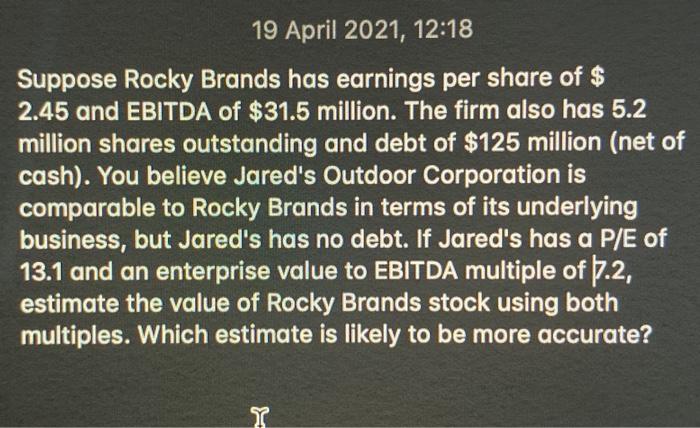

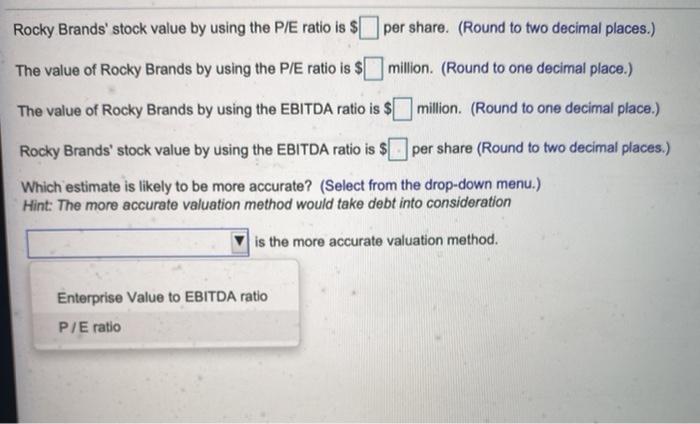

Suppose Rocky Brands hos con perse of $2,45 and EBITOA of 31.5 million. The 52 on wes landing and debt of 125 millioner of can you beteve Jared's Outdoor Corporation is complet ocky landsintom of its underlying business. Jedan odt. Je to PE of 111 and an enterprise EBITDA mutole of 72. state the value of Rocky Brands wooking bote Which is ay be more accurate Rocky Brandstock value by using the PE sper share Round towe doma The of Rocky Brande by using the Pitton Hound to che decimale) The of flocky Branco ty ng EBITDA stmilion Round new Rocky Bok Value by wing the EOTDA sound to be maces) Wichstimate is hy to be more at the crom the drop-down menu) at The more accurate in the wowote debito con Ne moreton method Emprise Vie EBITDA PE Suppose Rocky Brands has earnings per share of $2.45 and EBITDA of $31.5 million. The firm also has 52 million shares outstanding and debt Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of 13.1 and an enterprise value to EBITDA multiple of 7.2 accurate? Rocky Brands' stock value by using the P/E ratio is super share. (Round to wo decimal places.) The value of Rocky Brands by using the P/E ratio is $ million, (Round to one decimal place.) The value of Rocky Brands by using the EBITDA ratio is $million (Round to one decimal place.) Rocky Brands' stock value by using the EBITDA ratio in $ per sharo (Round to two decimal places) Which estimate is likely to be more accurato? (Select from the drop-down menu.) Hint. The more accurato valuation method would take debt into consideration is the more accurate valuation method. Enterprise Value to EBITDA ratio P/E ratio 19 April 2021, 12:18 Suppose Rocky Brands has earnings per share of $ 2.45 and EBITDA of $31.5 million. The firm also has 5.2 million shares outstanding and debt of $125 million (net of cash). You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of 13.1 and an enterprise value to EBITDA multiple of 7.2, estimate the value of Rocky Brands stock using both multiples. Which estimate is likely to be more accurate? Y Rocky Brands' stock value by using the P/E ratio is $ per share. (Round to two decimal places.) The value of Rocky Brands by using the P/E ratio is $ million. (Round to one decimal place.) The value of Rocky Brands by using the EBITDA ratio is $ million. (Round to one decimal place.) Rocky Brands' stock value by using the EBITDA ratio is $ per share (Round to two decimal places.) Which estimate is likely to be more accurate? (Select from the drop-down menu.) Hint: The more accurate valuation method would take debt into consideration is the more accurate valuation method. Enterprise Value to EBITDA ratio P/E ratio