Question

Suppose {rt} represents the continuously compounded weekly return on a stock such that each return is independently identically distributed as a normal distribution with

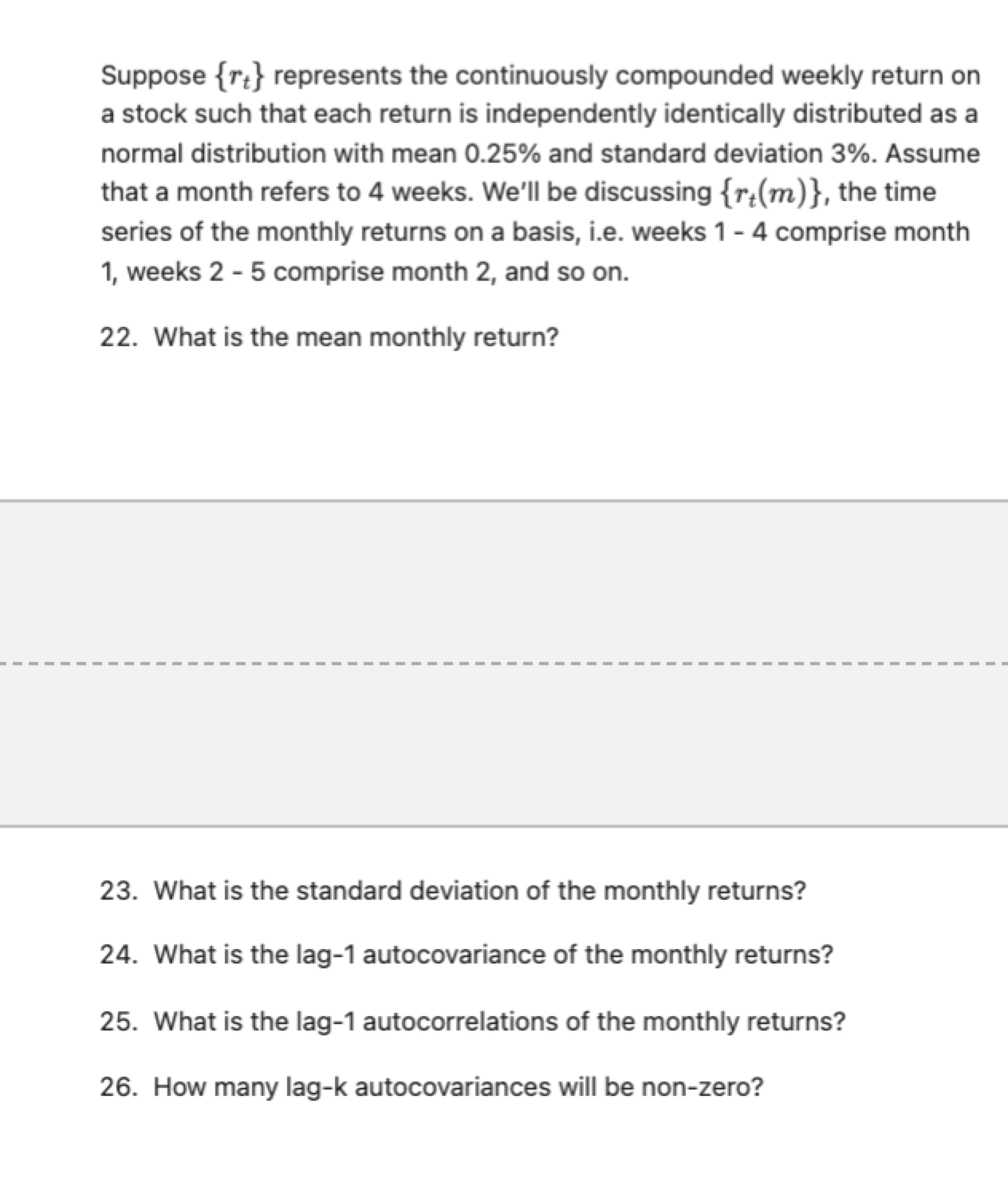

Suppose {rt} represents the continuously compounded weekly return on a stock such that each return is independently identically distributed as a normal distribution with mean 0.25% and standard deviation 3%. Assume that a month refers to 4 weeks. We'll be discussing {rt(m)}, the time series of the monthly returns on a basis, i.e. weeks 1 - 4 comprise month 1, weeks 2 - 5 comprise month 2, and so on. 22. What is the mean monthly return? 23. What is the standard deviation of the monthly returns? 24. What is the lag-1 autocovariance of the monthly returns? 25. What is the lag-1 autocorrelations of the monthly returns? 26. How many lag-k autocovariances will be non-zero?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

9th Edition

73530700, 978-0073530703

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App