Answered step by step

Verified Expert Solution

Question

1 Approved Answer

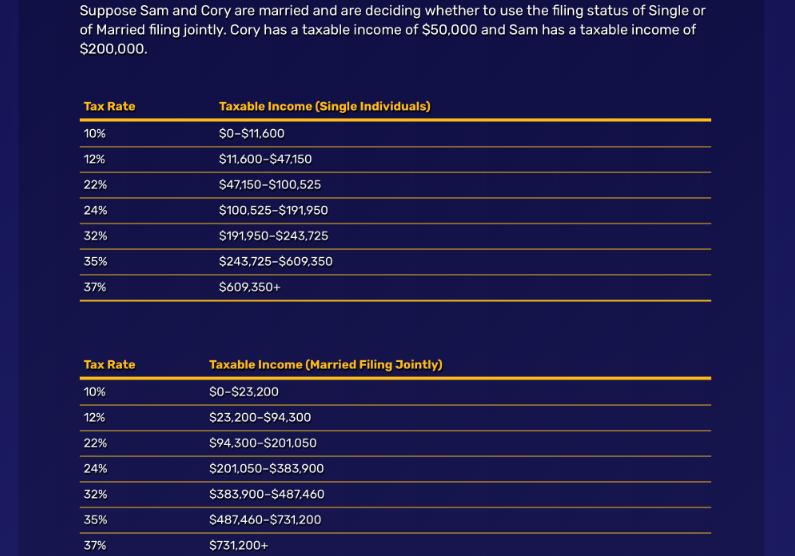

Suppose Sam and Cory are married and are deciding whether to use the filing status of Single or of Married filing jointly. Cory has

Suppose Sam and Cory are married and are deciding whether to use the filing status of Single or of Married filing jointly. Cory has a taxable income of $50,000 and Sam has a taxable income of $200,000. Tax Rate 10% Taxable Income (Single Individuals) 12% 22% $0-$11,600 $11,600-$47,150 $47,150-$100,525 24% $100,525-$191,950 32% 35% $191,950-$243,725 $243,725-$609,350 37% $609,350+ Tax Rate 10% 12% 22% Taxable Income (Married Filing Jointly) $0-$23,200 $23,200-$94,300 $94,300-$201,050 24% $201,050-$383,900 32% $383,900-$487,460 35% $487,460-$731,200 37% $731,200+ 37% $731,200+ If they decide to file as Married Filing Jointly, how much would they owe in federal income taxes? If they decide to file as Married Filing Jointly, they simply combine their taxable incomes and use the new tax rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started