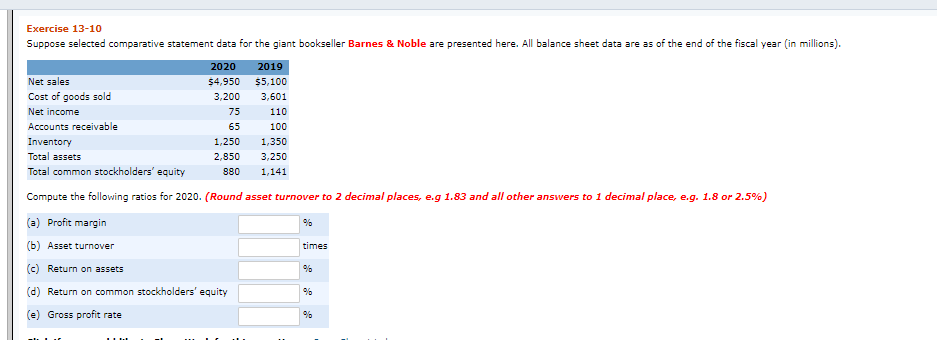

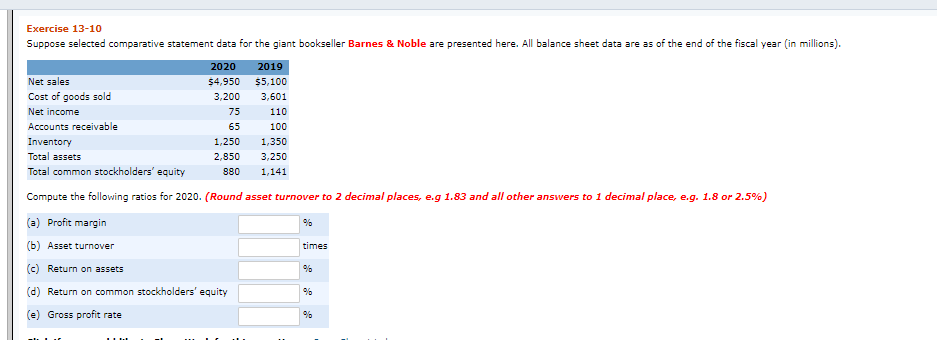

Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions).

| | | 2020 | | 2019 |

| Net sales | | $4,950 | | $5,100 |

| Cost of goods sold | | 3,200 | | 3,601 |

| Net income | | 75 | | 110 |

| Accounts receivable | | 65 | | 100 |

| Inventory | | 1,250 | | 1,350 |

| Total assets | | 2,850 | | 3,250 |

| Total common stockholders equity | | 880 | | 1,141 |

Compute the following ratios for 2020.

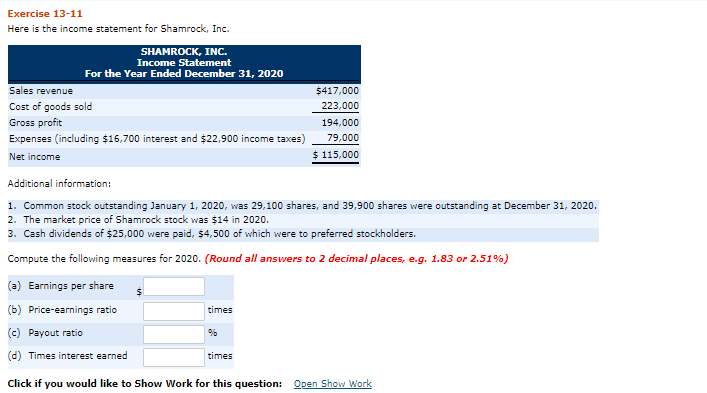

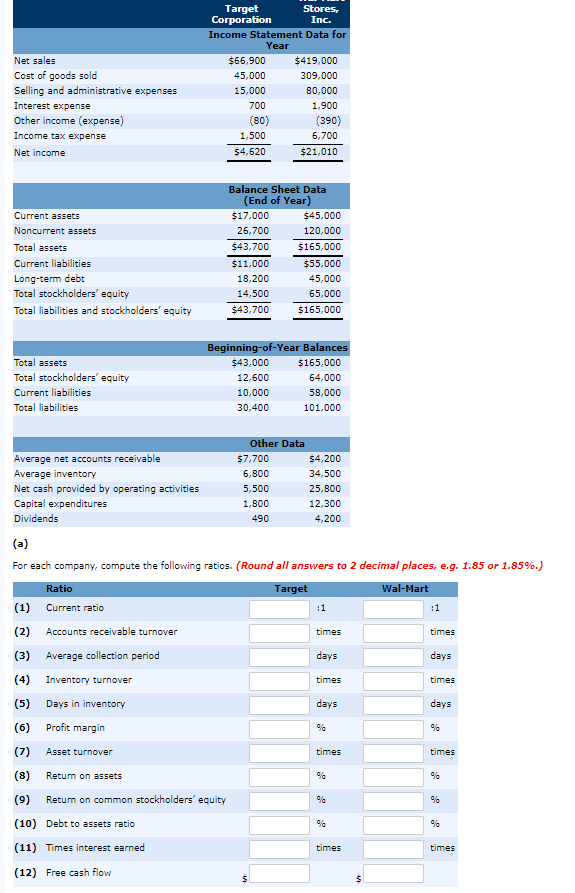

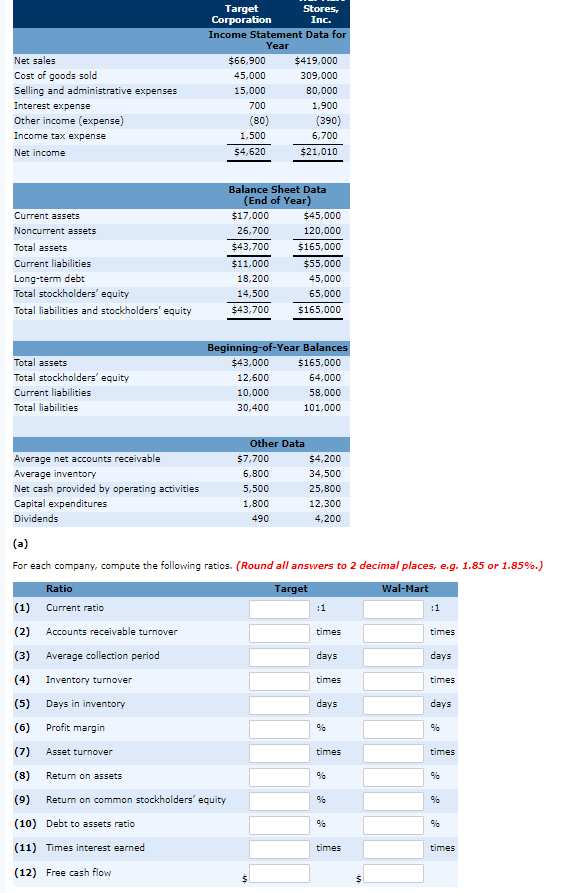

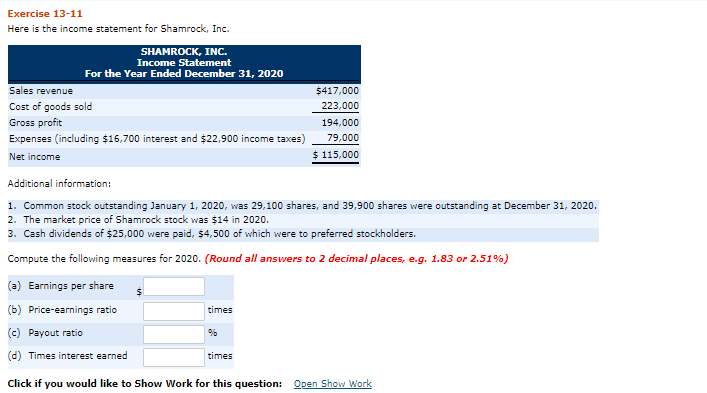

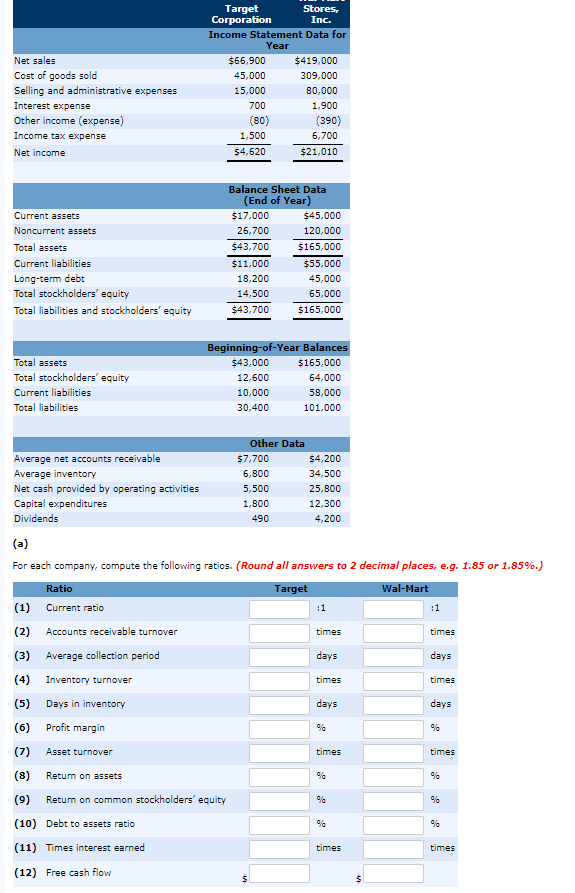

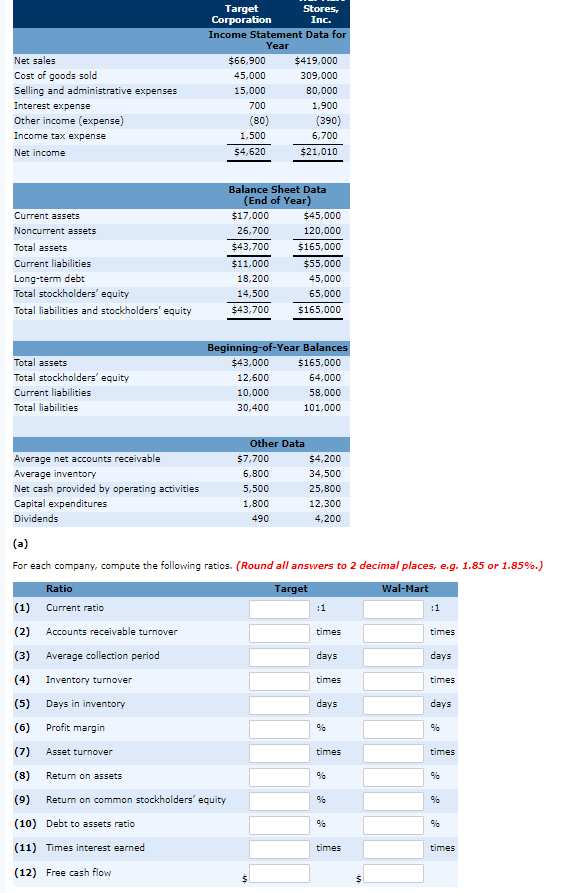

Exercise 13-10 Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). Net sales Cost of goods sold Net income Accounts receivable Inventory Total assets Total common stockholders' equity 2020 2019 54,950 $5,100 3,200 3,601 75 110 65100 1,250 1,350 2,850 3,250 880 1,141 Compute the following ratios for 2020. (Round asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) (a) Profit margin (b) Asset turnover times (c) Return on assets (d) Return on common stockholders' equity (e) Gross profit rate Exercise 13-11 Here is the income statement for Shamrock, Inc. SHAMROCK, INC. Income Statement For the Year Ended December 31, 2020 Sales revenue Cost of goods sold Gross profit Expenses (including $16,700 interest and $22.900 income taxes) taxes) Net income $417,000 223,000 194,000 79,000 $ 115,000 Additional information: 1. Common stock outstanding January 1, 2020, was 29,100 shares, and 39,900 shares were outstanding at December 31, 2020. 2. The market price of Shamrock stock was $14 in 2020. 3. Cash dividends of $25,000 were paid, 54,500 of which were to preferred stockholders. Compute the following measures for 2020. (Round all answers to 2 decimal places, e.g. 1.83 or 2.51%) (a) Earnings per share times (b) Price-earnings ratio (c) Payout ratio (d) Times interest earned times Click if you would like to Show Work for this question: Open Show Work Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Target Stores, Corporation Inc. Income Statement Data for Year $66,900 $419,000 45,000 309,000 15,000 80,000 700 1,900 (80) (390) 1,500 6,700 54,620 $21,010 Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Balance Sheet Data (End of Year) $17,000 $45,000 26,700 120,000 $43,700 $165,000 $11,000 $55,000 18,200 45,000 14,500 65,000 $43,700 $165,000 Total assets Total stockholders' equity Current liabilities Total liabilities Beginning-of-Year Balances $43,000 $165,000 12,600 64,000 10,000 58,000 30,400 101,000 Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Dividends Other Data $7,700 $4,200 6,800 34,500 5,500 25,800 1,800 12,300 490 4,200 (a) For each company, compute the following ratios. (Round all answers to 2 decimal places, e.g. 1.85 or 1.85%.) Ratio Target Wal-Mart (1) Current ratio (2) Accounts receivable turnover times times (3) Average collection period days days (4) Inventory turnover times times (5) Days in inventory days days (6) Profit margin (7) Asset turnover times (8) Return on assets (9) Return on common stockholders' equity (10) Debt to assets ratio (11) Times interest earned times times (12) Free cash flow Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Target Stores, Corporation Inc. Income Statement Data for Year $66,900 $419,000 45,000 309,000 15,000 80,000 700 1,900 (80) (390) 1,500 6,700 54,620 $21,010 Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Balance Sheet Data (End of Year) $17,000 $45,000 26,700 120,000 $43,700 $165,000 $11,000 $55,000 18,200 45,000 14,500 65,000 $43,700 $165,000 Total assets Total stockholders' equity Current liabilities Total liabilities Beginning-of-Year Balances $43,000 $165,000 12,600 64,000 10,000 58,000 30,400 101,000 Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Dividends Other Data $7,700 $4,200 6,800 34,500 5,500 25,800 1,800 12,300 490 4,200 (a) For each company, compute the following ratios. (Round all answers to 2 decimal places, e.g. 1.85 or 1.85%.) Ratio Target Wal-Mart (1) Current ratio (2) Accounts receivable turnover times times (3) Average collection period days days (4) Inventory turnover times times (5) Days in inventory days days (6) Profit margin (7) Asset turnover times (8) Return on assets (9) Return on common stockholders' equity (10) Debt to assets ratio (11) Times interest earned times times (12) Free cash flow