Answered step by step

Verified Expert Solution

Question

1 Approved Answer

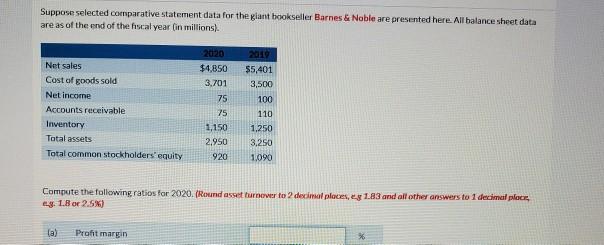

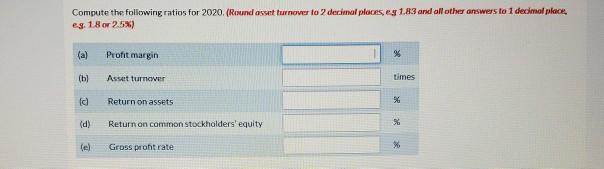

Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data areas of the end of the

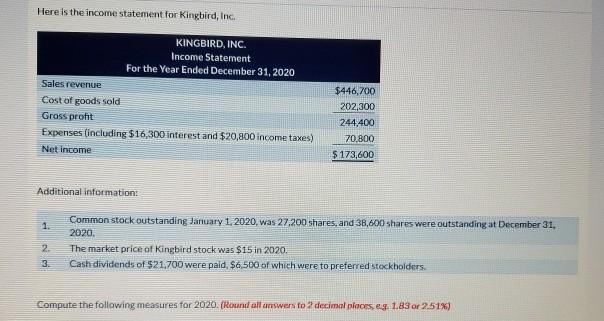

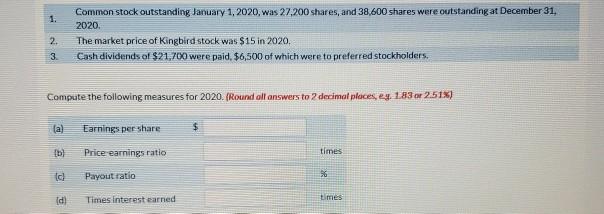

Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data areas of the end of the fiscal year (in millions). 2019 2020 $4,850 3,701 75 Net sales Cost of goods sold Net Income Accounts receivable Inventory Total assets Total common stockholders equity 75 1,150 $5,401 3,500 100 110 1.250 3,250 1.090 2.950 920 Compute the following ratios for 2020. (Round asset turnover to 2 decimal places, 1.83 and all other answers to 1 decimal place 4.3. 1.8 or 2.5%) (a) Profit margin Compute the following ratios for 2020. (Round ass turnover to 2 decimal places, ey 1.83 and all other answers to 1 decimal place, eg. 18 or 2.5%) (a) Profit margin % [b] Assat turnover times d Return on assets 96 (d) Return on common stockholders' equity % el Gross pront rate Here is the income statement for Kingbird, Inc. KINGBIRD, INC. Income Statement For the Year Ended December 31, 2020 Sales revenue Cost of goods sold Grass profit Expenses (including $16,300 interest and $20,800 income taxes) Net income $446,700 202,300 244,400 70.800 $ 173,600 Additional information: 1. Common stock outstanding January 1, 2020, was 27.200 shares, and 38,600 shares were outstanding at December 31, 2020 The market price of Kingbird stock was $15 in 2020. Cash dividends of $21.700 were paid $6,500 of which were to preferred stockholders. 2. 3 Compute the following measures for 2020. (Remarad all answers to 2 decimal places, eg 1.83 or 251%) 1. Common stock outstanding January 1, 2020, was 27,200 shares, and 38,600 shares were outstanding at December 31, 2020. The market price of Kingbird stock was $15 in 2020, Cash dividends of $21,700 were paid $6,500 of which were to preferred stockholders, 2. 3. Compute the following measures for 2020. (Round all answers to 2 decimal places, ey 1.83 of 251x) (a) $ Earnings per share [6] Price-earnings ratio times Id Payout ratio 56 Id) Times Interest earned times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started