Question

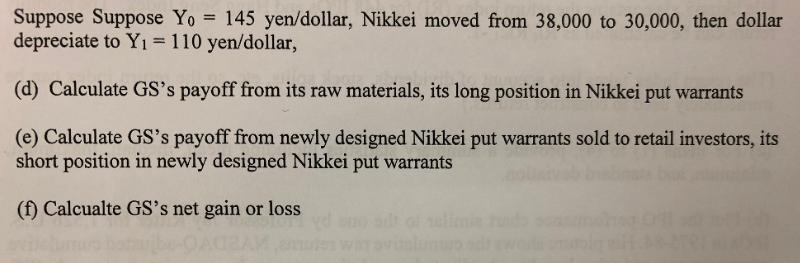

Suppose Suppose Yo = 145 yen/dollar, Nikkei moved from 38,000 to 30,000, then dollar depreciate to Y1 = 110 yen/dollar, %3D (d) Calculate GS's

Suppose Suppose Yo = 145 yen/dollar, Nikkei moved from 38,000 to 30,000, then dollar depreciate to Y1 = 110 yen/dollar, %3D (d) Calculate GS's payoff from its raw materials, its long position in Nikkei put warrants (e) Calculate GS's payoff from newly designed Nikkei put warrants sold to retail investors, its short position in newly designed Nikkei put warrants (f) Calcualte GS's net gain or loss

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A Payoff from newly designed Nikkei ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App