Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that a bank trading desk has just entered into a hypothetical 2x5 squared FRA where the bank pays a fixed rate and receives

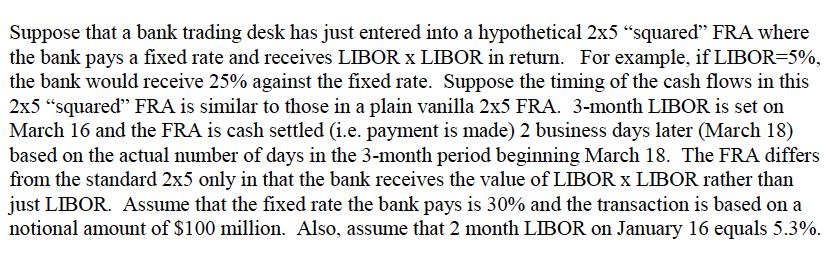

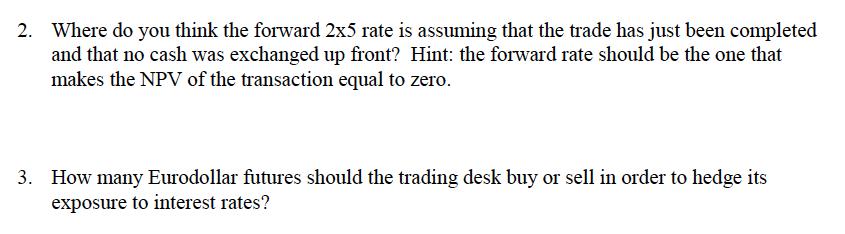

Suppose that a bank trading desk has just entered into a hypothetical 2x5 "squared" FRA where the bank pays a fixed rate and receives LIBOR X LIBOR in return. For example, if LIBOR=5%, the bank would receive 25% against the fixed rate. Suppose the timing of the cash flows in this 2x5 "squared" FRA is similar to those in a plain vanilla 2x5 FRA. 3-month LIBOR is set on March 16 and the FRA is cash settled (i.e. payment is made) 2 business days later (March 18) based on the actual number of days in the 3-month period beginning March 18. The FRA differs from the standard 2x5 only in that the bank receives the value of LIBOR X LIBOR rather than just LIBOR. Assume that the fixed rate the bank pays is 30% and the transaction is based on a notional amount of $100 million. Also, assume that 2 month LIBOR on January 16 equals 5.3%. 2. Where do you think the forward 2x5 rate is assuming that the trade has just been completed and that no cash was exchanged up front? Hint: the forward rate should be the one that makes the NPV of the transaction equal to zero. 3. How many Eurodollar futures should the trading desk buy or sell in order to hedge its exposure to interest rates?

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine the forward 2x5 rate we need to calculate the net present value NPV of the trans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started