Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that a firm is considering an investment opportunity. If the economy condition is boom, the investment will be worth $2,000 today. If the

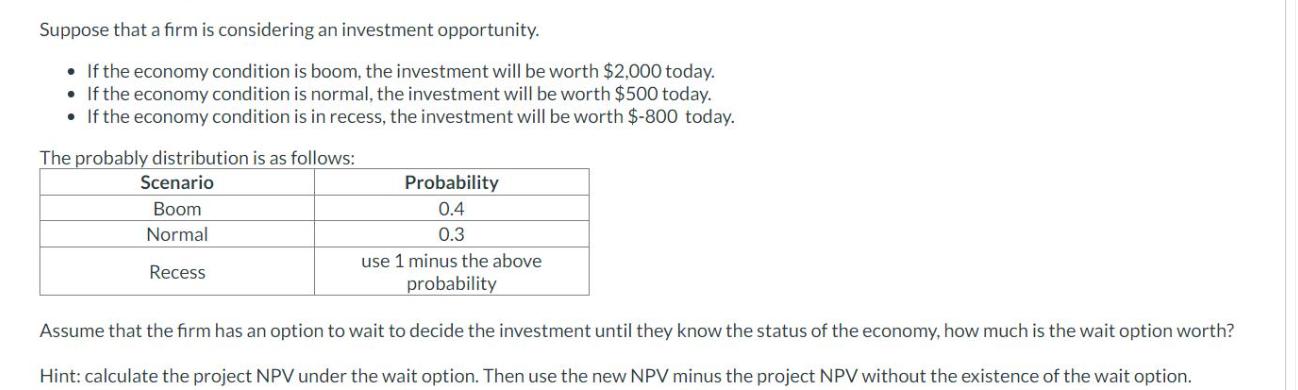

Suppose that a firm is considering an investment opportunity. If the economy condition is boom, the investment will be worth $2,000 today. If the economy condition is normal, the investment will be worth $500 today. If the economy condition is in recess, the investment will be worth $-800 today. The probably distribution is as follows: Scenario Boom Normal Recess Probability 0.4 0.3 use 1 minus the above probability Assume that the firm has an option to wait to decide the investment until they know the status of the economy, how much is the wait option worth? Hint: calculate the project NPV under the wait option. Then use the new NPV minus the project NPV without the existence of the wait option.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Heres how to calculate the value of the wait option for this investment 1 Expected Value Without Wai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started