Answered step by step

Verified Expert Solution

Question

1 Approved Answer

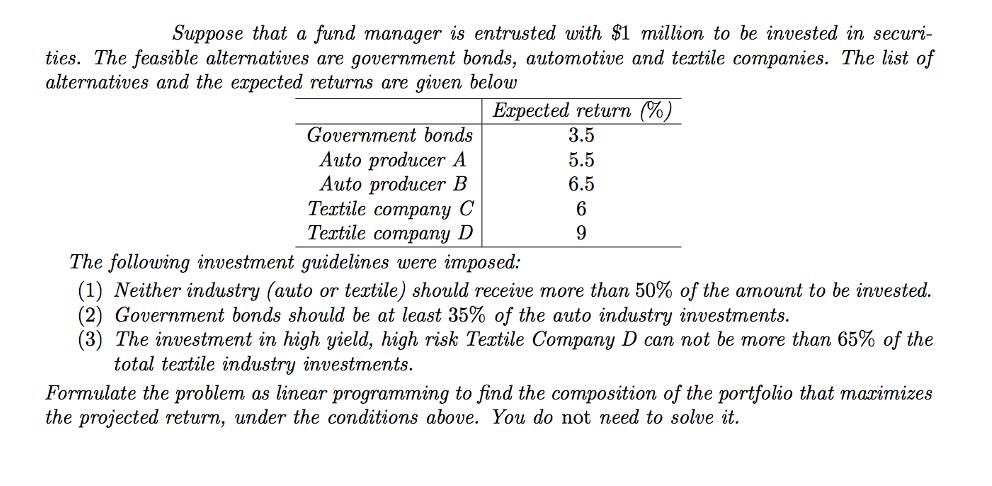

Suppose that a fund manager is entrusted with $1 million to be invested in securi- ties. The feasible alternatives are government bonds, automotive and

Suppose that a fund manager is entrusted with $1 million to be invested in securi- ties. The feasible alternatives are government bonds, automotive and textile companies. The list of alternatives and the expected returns are given below Government bonds Auto producer A Auto producer B Textile company C Textile company D Expected return (%) 3.5 5.5 6.5 6 9 The following investment guidelines were imposed: (1) Neither industry (auto or textile) should receive more than 50% of the amount to be invested. (2) Government bonds should be at least 35% of the auto industry investments. (3) The investment in high yield, high risk Textile Company D can not be more than 65% of the total textile industry investments. Formulate the problem as linear programming to find the composition of the portfolio that maximizes the projected return, under the conditions above. You do not need to solve it.

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Let 1 1 13 14 all my are the proportions to be invested in se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started