Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that a local bank lends $10,000,000 to an investor that uses the proceeds to finance, in part, the acquisition of a $15,000,000 investment

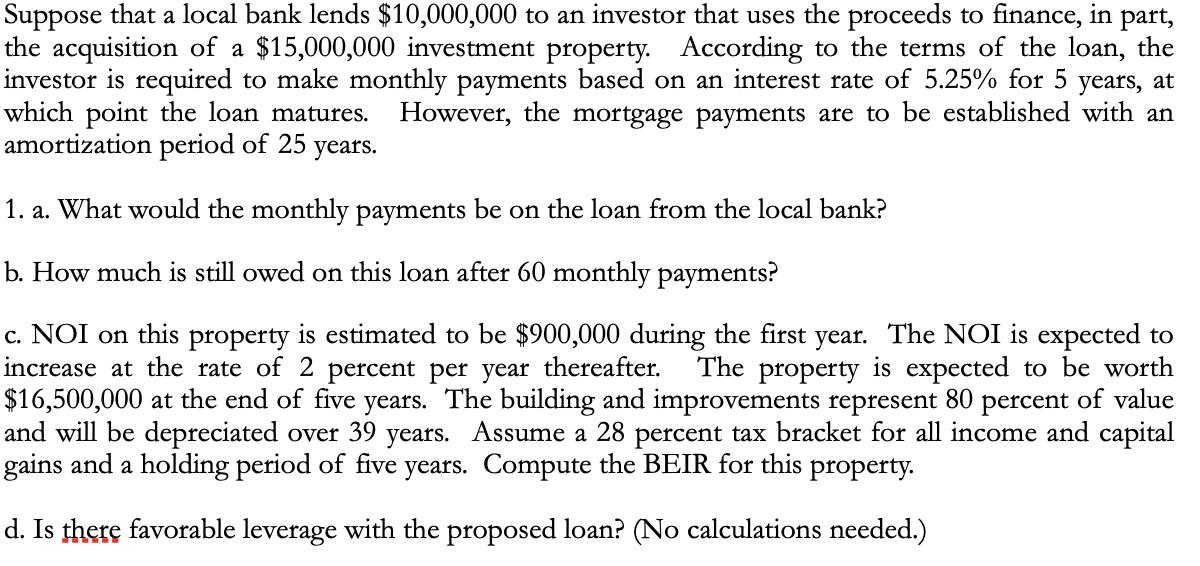

Suppose that a local bank lends $10,000,000 to an investor that uses the proceeds to finance, in part, the acquisition of a $15,000,000 investment property. According to the terms of the loan, the investor is required to make monthly payments based on an interest rate of 5.25% for 5 years, at which point the loan matures. However, the mortgage payments are to be established with an amortization period of 25 years. 1. a. What would the monthly payments be on the loan from the local bank? b. How much is still owed on this loan after 60 monthly payments? c. NOI on this property is estimated to be $900,000 during the first year. The NOI is expected to increase at the rate of 2 percent per year thereafter. The property is expected to be worth $16,500,000 at the end of five years. The building and improvements represent 80 percent of value and will be depreciated over 39 years. Assume a 28 percent tax bracket for all income and capital gains and a holding period of five years. Compute the BEIR for this property. d. Is there favorable leverage with the proposed loan? (No calculations needed.)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 a The monthly payment would be 10000000 00525 12 416667 15000000 00525 12 625...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started