Question

Suppose that a mortgage of $200,000 is to be repaid over 20 years at an annual interest rate of 5%. Using the formula for

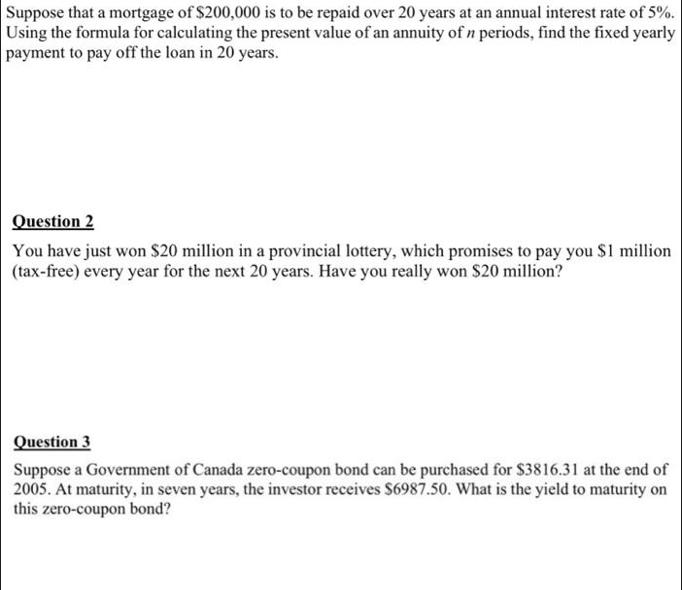

Suppose that a mortgage of $200,000 is to be repaid over 20 years at an annual interest rate of 5%. Using the formula for calculating the present value of an annuity of n periods, find the fixed yearly payment to pay off the loan in 20 years. Question 2 You have just won $20 million in a provincial lottery, which promises to pay you $1 million (tax-free) every year for the next 20 years. Have you really won $20 million? Question 3 Suppose a Government of Canada zero-coupon bond can be purchased for $3816.31 at the end of 2005. At maturity, in seven years, the investor receives $6987.50. What is the yield to maturity on this zero-coupon bond?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 To find the fixed yearly payment to pay off the mortgage loan of 200000 over 20 years at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Multinational Finance Evaluating Opportunities Costs and Risks of Operations

Authors: Kirt C. Butler

5th edition

1118270126, 978-1118285169, 1118285166, 978-1-119-2034, 978-1118270127

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App