Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that a one-year discount bond that pays off one dollar for sure one year from now sells for P = 0.90 today, a

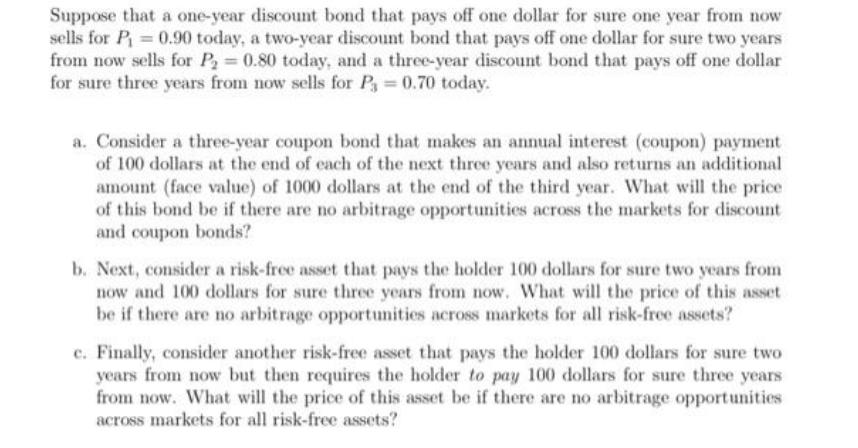

Suppose that a one-year discount bond that pays off one dollar for sure one year from now sells for P = 0.90 today, a two-year discount bond that pays off one dollar for sure two years from now sells for P = 0.80 today, and a three-year discount bond that pays off one dollar for sure three years from now sells for P = 0.70 today. a. Consider a three-year coupon bond that makes an annual interest (coupon) payment of 100 dollars at the end of each of the next three years and also returns an additional amount (face value) of 1000 dollars at the end of the third year. What will the price of this bond be if there are no arbitrage opportunities across the markets for discount and coupon bonds? b. Next, consider a risk-free asset that pays the holder 100 dollars for sure two years from now and 100 dollars for sure three years from now. What will the price of this asset be if there are no arbitrage opportunities across markets for all risk-free assets? c. Finally, consider another risk-free asset that pays the holder 100 dollars for sure two years from now but then requires the holder to pay 100 dollars for sure three years from now. What will the price of this asset be if there are no arbitrage opportunities across markets for all risk-free assets?

Step by Step Solution

★★★★★

3.32 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the prices of the given securities a ThreeYear Coupon Bond The price of the bond will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started